For anyone who knows they should be investing but doesn’t know how to get started, the wave of micro-investing apps that have appeared over the last few years could be just what you need.

And in any discussion about these apps, the question will often come up: Acorns vs Robinhood.

Both are apps that are used by thousands of people who have struggled to start investing in more traditional ways. They’re also both widely praised for addressing the different needs of users who are dipping their toes into the investment pool.

However, in most discussions about these apps, the writer will usually conclude that “they’re both good in different ways” rather than picking an outright winner.

This isn’t one of those kinds of articles.

Instead, we’re convinced that one of them is easily better than the other given what these apps aim to achieve – which is helpful given that you’re probably not planning to download both of them.

Keep reading to find out why.

Acorns vs Robinhood: Which one is better?

Let’s not beat around the bush: we’re crowning the winner of the Acorns vs Robinhood battle as Acorns.

This is purely because of the purpose of these apps: to make investing more accessible to those who haven’t been able to start investing through more traditional means.

Both apps absolutely have their benefits, but Acorns not only will help people start investing, but is also great for those who struggle to save money.

Acorns

Ideal for beginner investors

Want to start investing but always think that you don’t have enough money left over each month? Then Acorns is for you.

It automatically rounds up and invests your spare change, making it a great choice for starting to save and build wealth – without even noticing!

How good is Acorns as a micro-investing app?

As far as micro-investing apps go, Acorns is one of the best for showing you just how you can save some of your money without even noticing, with the idea that you’ll then scale this up to save more and more each month.

And the fact this money goes into the investment of your choice means it’s a double whammy of showing you just what you should be doing with your money – again, with the aim that you’ll start doing this yourself on a much larger scale.

That small monthly fee does hurt a bit, but if that’s what it takes to get you saving and investing, then I think it’s worth it. Just don’t leave this as your only way of investing for too long, as there are far cheaper options out there once you can manage this yourself.

Robinhood, on the other hand, is a great app for those looking to easily buy stocks – and for free!

But there are limitations as to what you can buy through this app. If you’re at the point of having enough knowledge to know where you want to invest, these limitations could prevent you from building your ideal portfolio. This is especially shown in the fact that you can’t buy bonds or mutual funds through Robinhood.

If this sounds more like the way that you’re looking to invest, you can go directly and open a brokerage account with a company like Charles Schwab. Opening an account with them is free, there’s no minimum deposit and they have $0 online trades. They also have more options for what you can buy, like our recommendations for the best Schwab index funds.

Alternatively, if you do want to keep it simple with something like what Robinhood offers, check out Webull instead.

Like Robinhood, their accounts are completely free and trades cost $0.

But the best part is their sign up bonuses, which are practically unbeatable:

- For opening a free account, you’ll receive one free stock from a random company valued between $2.50 and $250

- Make an initial deposit of at least $100 and receive another free stock from a random company valued between $12 and $1,400

- Refer a friend to Webull and get two free stocks or refer three friends and get nine free stocks, each of which will be worth between $12 and $1,400

Acorns

So why exactly do we think Acorns has Robinhood pipped at the post? We’ll break it down for you here.

About Acorns

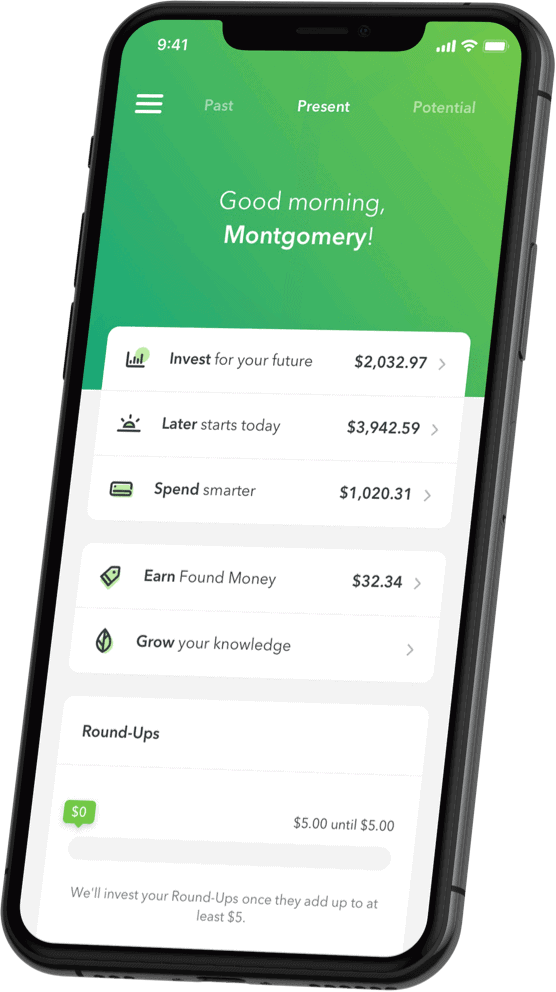

Acorns does a neat little trick to help those who think they’re not able to save any money each month, as well as those who don’t really know how to start investing.

How it works is that every time you buy something on your debt or credit card or through PayPal, the app rounds up the change to the nearest dollar and transfers the difference to a separate account.

So say you spend $2.40 on a coffee. Acorns takes the extra $0.60 and invests it into a portfolio of your choosing. This means that you’re basically saving and investing without even noticing.

It’s estimated that Acorns saves people (and invests for them) an average of $30 per month. While this isn’t life changing, it’s clearly a good start for those who weren’t saving or investing anything at all before starting to use the app.

Related: The 11 Best Compound Interest Accounts to Grow Your Wealth

Investment options

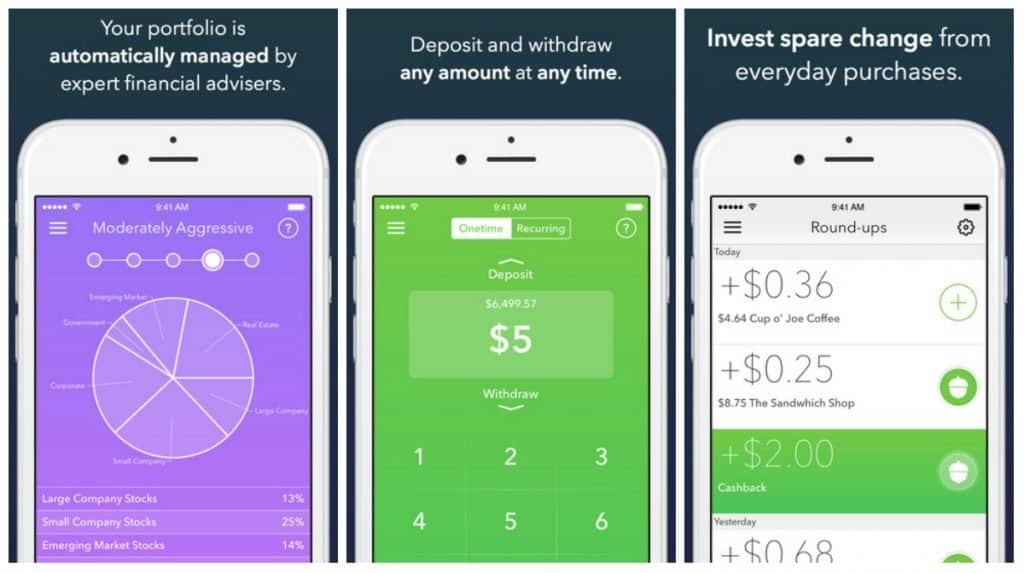

With Acorns, you pick how your portfolio will look like. There are more than $1 billion invested through Acorns already, with the choice of portfolios including the following:

- Aggressive

- Moderately aggressive

- Moderate

- Moderately conservative

- Conservative

The portfolios consist of exchange traded funds, or ETFs, with a mix of stocks and bonds depending on the type of portfolio you choose.

As an example, you can see the asset allocation in the aggressive portfolio compared to the conservative one below.

Every dollar you invest is spread automatically over 7,000 stock and bond ETFs, so it certainly meets the need for investments to be diversified. Your portfolio is also automatically rebalanced to make sure it stays within its target allocation.

In addition, you can choose for your portfolio to be held in a retirement account through their “Acorns Later” service, which has various tax advantages.

Related: VOO & SPY: Which S&P 500 ETF is Best?

Minimum investment

There’s no minimum amount that you have to have in your Acorns account and fees only start accruing once money is in there.

However, for your money to start being invested, you have to have at least $5 in rounded up change.

Types of accounts

Acorns has two types of accounts:

- Acorns Lite – This account lets you enjoy the full “round up your change” service, including investing it in the portfolio of your choice. You can also take advantage of the “Found Money” service in this account, which we’ll outline below.

- Acorns Personal – This plan gives you everything that Acorns Lite has, plus letting you put your money in a retirement account for the extra tax benefits this offers. You’ll also have access to Acorns Spend, a fee-free checking account they offer which lets you earn 10% more in bonus investments.

Fees

The fees are probably the biggest negative of Acorns. They are:

- $1 per month for Acorns Lite

- $3 per month for Acorns Personal

That may not sound like much, but it can add up over time, especially if you don’t keep much money in your Acorns account.

For example, say you use Acorns Personal and invest the average of $30 per month. Those fees are now 10% of your monthly savings and investments.

That’s quite a lot, especially when you compare it to a total stock market index fund like VTSAX or VTI. For them, the fees are only 0.04% and 0.03% per annum respectively.

At the same time, I’d argue that Acorns shouldn’t be seen as a long term investment strategy. Instead, it’s a way to show you how easy it is to save and invest regularly.

Both of these are critical for anyone looking to secure their financial future. And if the cost of that lesson is either $12 or $36 per year, then this could be more than worthwhile.

Just make sure that, once you get the hang of it, you switch to a lower cost investment vehicle to really maximize your returns.

Customer service

You can contact Acorns at any time either by sending a message through their site or by giving them a call.

(Although, weirdly, their customer service number appears to only be found in their gift cards section. A simple Google search will find it for you if you need it though.)

Security

Acorns appears to be very secure with no major data breaches having been reported. Specifically, they have the following security protections:

- You’ll be alerted if there’s any unusual activity in your account

- The website and app is encrypted, including multi-factor authentication

- Each account is SIPC protected up to $500,000, including $250,000 claims for cash

- Acorns does not store your bank login details

Related: How to Invest $25k: 13 Strategies to Grow Your Wealth

Other points

Acorns also offers Acorns Found Money. How it works is that it’s basically a cash back service, in that if you shop at one of its partners, which include Airbnb, Walmart, Macy’s and more, you’ll automatically earn a bonus investment.

It’s completely free and a nice little perk. That said, other apps that offer this have way more partners, meaning far more opportunities for you to earn money back on your purchases.

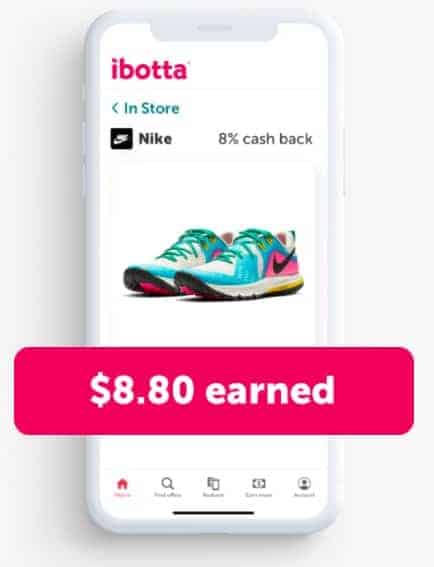

Ibotta, for example, provides money back on spending at over 500,000 retailers. Plus the amazing free $20 sign-up bonus is definitely something to consider.

Ibotta

Free sign-up bonus: $20

Ibotta is a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

In fact, users make $150 per year on average – not including your free $20 welcome bonus – with over $682 million having been paid out, so you know Ibotta is definitely legit.

Acorns Pros

- Very easy to save and invest without even noticing

- Good range of portfolios that will suit any investor

- Completely automated, meaning you can stay essentially hands-off

- This includes automatic investments either daily, weekly or monthly, depending on the frequency you choose (assuming you have $5 of rounded up change to move over to your investments)

Acorns Cons

- The fees of $1 or $3 per month sound reasonable, but are quite high relative to the amount of money you’ll probably be saving (although you can see our argument above for why these fees could actually be considered fair).

- If you prefer having more control over your investments, the pre-selected portfolios may not be for you

Who is Acorns best for?

Acorns is ideal for anyone who has struggled in the past to save money each month, as well as those who want to start investing but don’t think it’s possible or aren’t sure what to do.

By only taking a small amount of change from each expense, users will barely notice that they’re saving money, let alone that they’ve actually turned into investors without even realizing it.

If you already have some idea about investing and are keen to get started yourself by, say, investing in index funds to grow your wealth, Acorns is probably not for you.

But if the whole investing thing just sounds confusing or overwhelming, Acorns is a great place for you to start to see that, actually, this is definitely something you can manage.

Robinhood

And now for the next contender in the question of Acorns vs Robinhood!

About Robinhood

Robinhood is a trading app that was founded to fight the past practice of most companies charging $10 per trade.

The founders of Robinhood firmly believed that everyone, no matter who they are, should have access to the same low-cost trades that massive trading firms utilise.

So they created an app that aims to open up the world of fee-free investing to anyone, no matter if they’re the Wolf of Wall Street or Joe Down the Road.

Investment options

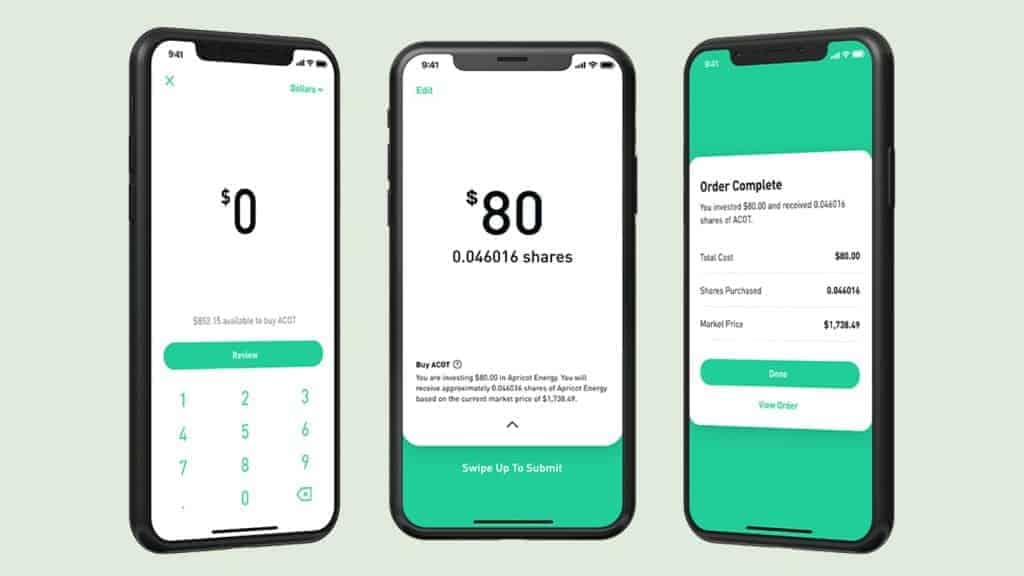

Robinhood lets you invest in a range of different assets, including basically any stock that’s publicly traded on the US stock market, including ETFs, as well as others like cryptocurrency.

You can also invest in fractional shares, which is a great feature. What this means is that you only need $1 to add a stock to your portfolio, instead of when you have to buy a full stock which could cost far more.

(For example, at the time of writing this, if you wanted to invest in Apple by buying a full stock, you’d currently have to pay $331.50.)

However, one area where Robinhood falls short is the fact that it doesn’t let you invest in mutual funds or bonds. For anyone looking to build a well-balanced, relatively risk-averse portfolio, bonds are considered a must.

Related: The 8 Best Schwab Index Funds

Minimum investment

There’s no minimum balance needed to open a Robinhood account, nor do you have to invest a certain amount.

In fact, as we just mentioned, you really only need $1 to buy any stock through its fractional shares, rather than the full amount of the stock.

Types of accounts

Robinhood’s standard account lets you buy and sell stocks to your heart’s content.

And when you join, you’ll receive one free stock in your account valued at up to $199.13. Options for the free stock include Microsoft, Visa, Johnson & Johnson, GE and more.

There’s also the option of opening a Gold account with Robinhood. This lets you have access to more detailed market analytics, longer trading hours and $1,000 to trade on margin.

This account type has a fee, but you can try it for free for 30 days.

That said, for most everyday investors, this probably isn’t necessary and the standard account will be more than enough.

Fees

Opening a standard account and buying shares through Robinhood is completely fee-free.

It is, however, worth noting that there are some fees for other activities. For example, if you decide to trade any non-US stocks, there’s a pretty painful fee of $50 per trade, so make sure you read the fine print before doing anything through Robinhood beyond simple trades.

For the Gold account, the fees after the 30-day free trial are $5 per month. You’ll also be charged 5% interest on the balance of any margin trading above the initial $1,000 limit.

Customer service

Robinhood’s customer service isn’t great, to be honest. In fact, if you spend any time on Reddit, Robinhood customer service complaints are frequently mentioned.

The main issue is that you can only contact them by email (although you can find a phone number if you do a lot of internet digging) and that they can take upwards of a week to reply. And if you do manage to find their phone number, you can only call during market hours (i.e. 9:30am to 4:00pm EST).

Security

Robinhood has a number of security measures in place, including:

- Like Acorns, your account is SIPC-protected, meaning you’re covered for up to $500,000 including $250,000 claims for cash

- Once they verify your banking credentials, Robinhood will no longer have access to them

- You can secure your account access through measures such as FaceID and two-factor authentication

- Sensitive details, like your social security number, are encrypted before they’re stored

It’s worth noting that Robinhood did report a major security issue in July 2019 in which users’ passwords were exposed. That said, they also stated at the time that there was no evidence that the information was improperly accessed.

Other points

Points definitely need to be awarded for Robinhood’s app, which is very slick and very simple to use. Their desktop application is also really easy to use and look at, making them highly accessible to even beginner investors who may find other platforms a bit overwhelming.

Robinhood Pros

- The free trades are easily the biggest pro. It’s clear why this is the main reason that people choose to use Robinhood.

- The fee-free account is also really nice

- Having access to fractional shares is great for those who may want to invest in major companies but don’t have the cash to do so

Robinhood Cons

- The fact that Robinhood does not allow you to invest in bonds or mutual funds is a major downside, especially for anyone looking to create a balanced portfolio with asset allocation across multiple areas

- Their customer service doesn’t have the best reputation

- For more advanced investors, it may be an issue that margin trading is only available for those with Gold accounts, as well as the fact that Robinhood doesn’t provide much detailed information in order to undertake your own analysis of potential investments. That said, you can find this information on other sites, although it would be nice if it were all in one.

Who is Robinhood best for?

Robinhood is great for anyone who’s looking to start investing in stocks and wants a simple way to do so. The app is easy to use, the fact that you can buy fractional shares makes investing more accessible and the lack of fees is a clear win.

That said, there are other apps that offer similar services but with better bonuses – which is why we recommend you check out Webull as an alternative, to take advantage of the free stocks they offer when you sign-up.

Alternatively, if you’re like many investors and don’t want a portfolio that consists solely of shares, the fact that Robinhood doesn’t provide for investing in bonds and mutual funds is our major concern with this platform.

Many will want to hold some bonds as a way to balance out the potential volatility of owning shares and mutual funds can also offer a great way to own low-cost, diversified investments.

This is why it may be better for you to consider opening a fee-free brokerage account with a company like Charles Schwab instead, to take advantage of investments like these index mutual funds.

FAQs on Acorns vs Robinhood

Got some more points to clarify on the question of Acorns vs Robinhood? Take a look at our list below to see if this helps.

Can you get rich from Acorns?

Given the fact that Acorns involves rounding up your spare change and that the average amount of investments through the app each month is $30, you’re probably not going to get rich from Acorns.

That said, you can definitely build significant wealth by investing and if Acorns helps you learn how to do that so you can start investing larger amounts going forward, then it’s worth giving it a shot.

Can you lose money with Acorns?

Like any investment, when the market dips, so too will the value of your investment. And the same applies to your investments with Acorns.

At the same time, the fact that Acorns’ portfolios are very diversified will help with mitigating any losses and it’s very unlikely that your portfolio will drop to zero.

Is Acorns a good investment vehicle?

Acorns’ portfolios are good investment vehicles in terms of their diversification and the fact you can choose the level of risk to apply to your investments.

Just make sure you don’t plan to use it forever as while the monthly fees of only $1 or $3 seem very reasonable, they’re quite steep relative to the amounts you’ll be investing. This means that, once you get the hang of it, it’s better to switch to a lower cost alternative, such as one of these index funds.

Is Robinhood good for beginners?

Robinhood is definitely good for beginners who are looking to buy stocks. Its simple platform and fee-free accounts are perfect for anyone looking to dip their toes in the investing pool.

What’s wrong with Robinhood

Robinhood won’t work for any investor who’s at the point of wanting to diversify their portfolio beyond just stocks, due to the limitations in the platform. In particular, the fact it doesn’t allow you to buy mutual funds and bonds means that many investors won’t be able to use it for all their investing needs.

What is the catch with the Robinhood app?

The only possible catch with the Robinhood app is if you want to do anything that’s outside of their fee-free offerings, such as buying foreign stocks. In those cases, the fees can quickly add up.

That said, most people who are interested in using Robinhood probably won’t want to go to that level of trading. In any case, as always, it’s good to read the fine print before you make any investment decision, including to confirm the fees.

Can you actually make money on Robinhood?

You can definitely make money on Robinhood. Much like anyone who buys shares, when the stock price goes up, so too does the value of your portfolio.

Of course, this also means that you can lose money on Robinhood if the share price drops but as this app is targeted at beginner investors, this is a valuable lesson for anyone to learn.

Micro-investing

What is micro-investing?

Micro-investing is any platform that allows users to regularly save and invest small amounts of money.

These platforms aim to avoid some of the usual points that stop people from investing, such as account minimums or trading fees, while also seeking to show them just how easy it is for them to build some savings and assign these to investments.

Related: How to Invest and Make Money Daily: 7 Proven Strategies

What are micro-investing platforms?

Micro-investing platforms is basically any app or website that helps you micro-invest. Some people equate them as the 21st century’s equivalent of putting your spare change in a money jar.

Then, when the jar is full, you can take it to the bank and start earning interest on that change – or, in the case of micro-investing, put it in the stock market.

Which micro-investing app is best?

Acorns is one of the most notable micro-investing apps out there, as seen by the fact that more than $1 billion has already been invested through the platform.

Robinhood doesn’t provide the automated feature of putting some of your money aside, like Acorns, but it does go a long way to helping people invest small amounts that they wouldn’t otherwise consider investing.

Final thoughts on Acorns vs Robinhood

While we generally prefer Acorns given the purpose of apps like these, there’s no question that Robinhood serves its purpose well.

If you’re looking for a simple way to buy stops, you wouldn’t be going wrong if you chose to use Robinhood.

That said, if you want something slightly more diversified and still fee-free, there are better options out there. Similarly, if you want to use something like Robinhood but have the chance to earn more free shares (people have even been given free stocks in Facebook, Apple and Microsoft), Webull may be a better alternative.

Acorns, on the other hand, does just what it says on the box: takes your spare change and, without you even noticing, puts it to good use.

Whichever you choose, while micro-investing won’t make you rich, it will show you just how easily you too can save and invest to secure your financial future. Which is easily the best lesson you can take from using either of these apps.