Given how much of our budgets are taken up by housing costs, it’s no wonder that you may be looking into the cheapest way to live to see if it’s something you could do yourself.

Of course, this can quickly turn into a question of just how cheap you’re willing to go.

Are you willing to move away from your hometown to a cheaper one – or even to an entirely new country where the cost of living is far lower than where you are at the moment?

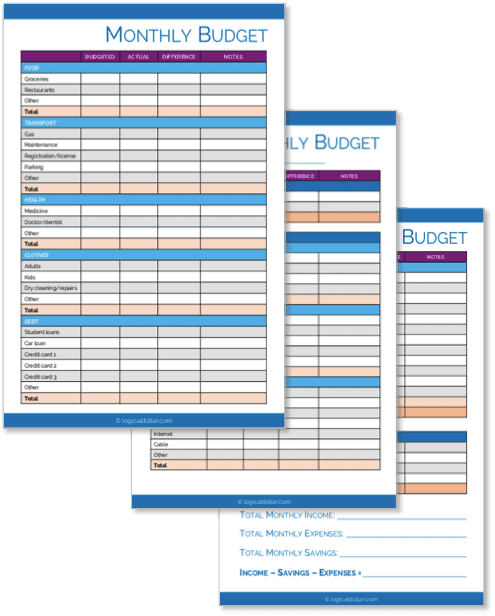

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

And are you able to sacrifice the comfort of a home for a cheaper way to live that may not be quite as comfortable or stable?

As you’ll see, the very cheapest way to live may be something – or somewhere – you haven’t even considered. At that point, whether or not it’s something that you can live with is up to you.

It’s also worth noting that the cheapest way to live isn’t only dependent on your housing situation. Plenty of other things can help you bring down your total cost of living, as we’ll set out below

One easy place to start is making sure you’re properly managing the money you do have to spend, which is why we always recommend Personal Capital as a way to do this. The fact that it’s free is just (cheap!) icing on the cake.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

What are the cheapest ways to live?

Living costs often make up the biggest portion of any household’s budget and a major determinant of this is going to be where you live.

It’s why a six-figure salary in San Francisco is now considered “low income”.

But when flipped around, this means that having the flexibility to move somewhere else – which may even be outside of your country of origin – can save you a lot of money.

In fact, it could be the choice that completely turns around your budget!

1. Move somewhere with a lower cost of living

Unsurprisingly, moving somewhere with a lower cost of living is going to make your money stretch a lot further.

This is especially the case if you’re able to maintain your current salary by working remotely. If that’s not an option for you, then you’re going to have to balance your earning potential in these places with how much you’ll spend to live there.

That is, while things like your expenses when renting may only be a fraction of what you currently pay, you may only be earning a fraction of your current salary too, meaning that a move may not be worth it.

Alternatively, making a move like this could mean that you never have to work again.

There are plenty of things to consider if you’re thinking about moving somewhere new, especially if it’s overseas. But from a primarily financial standpoint, some of the common questions are below.

Related: How to Live Without a Job: 8 Steps to Thrive

What is the cheapest and safest country to live in?

The cheapest and safest country to live in has been found to be Malaysia. This was based on various metrics, including the cost of local goods and services, the average rent price, the usual cost of groceries as well as things such as healthcare, safety and even the average temperature.

This article goes into how the analysis was done in more detail. In general though, Malaysia was found that it has an extremely low cost of living and quite a reasonable safety index.

What are the cheapest countries to live and work?

The cheapest countries in which to live and work were found to be:

- Malaysia

- Portugal

- Czech Republic

- Taiwan

- Slovenia

- Romania

- Bulgaria

- Indonesia

- Spain

- Sri Lanka

This was based on the findings in this article, which also considered local purchasing power when assembling its list. This means that it looked at the purchasing power of a typical salary in the country.

That is, a country that has a higher purchasing power means that you can buy more with your salary.

And with Malaysia again coming out on top here, it’s not hard to see why it was ranked one of the top 10 best destinations for expats to live and work.

What city has the cheapest cost of living worldwide?

According to the Economist Intelligence Unit, the cheapest city in the world to live in is Lusaka, Zambia. That said, they also note that foreigners tend to pay more there for housing, transportation and education.

The EIU uses a range of metrics to compare the cost of living in different cities around the globe, so you may want to check that link to see how they came to that conclusion.

(And before getting ready to move there, it’s also worth checking your government’s current travel advisory for Zambia. At the time of writing this, it’s not great, to put it mildly.)

What town has the cheapest rent in the US?

The cheapest place to rent a studio in the US is College Station, Texas. The cheapest place to rent a one-bedroom apartment in the US is Niles, Ohio. Finally, the cheapest place to rent a two-bedroom apartment in the US is Morganfield, Kentucky

These finds are based on the results of this study which compared 50 US cities based on rent prices compared to square feet of home. Based on this, it found which of them have the cheapest rent in the US for studios, one-bedroom and two-bedroom apartments.

It’s worth checking out the top 50 as some of the results may surprise you. That is, while the absolute cheapest options aren’t the biggest places in the country, some larger cities did make the list.

For example, the fourth cheapest place in the US to rent a studio is Tucson, Arizona – hardly a “town”.

What’s the cheapest place to live in the world that’s English speaking?

The World Population Review found in its cost of living index that the cheapest place to live in the world where English is an official language is Pakistan, where Urdu is also an official languages. That said, in almost all major cities around the world, you’re going to find some level of English.

Of course, this will definitely vary, but if you’re from an English-speaking country and are looking to move overseas, it’s worth considering countries with a different native language.

Not only is the experience invaluable, but there’s no reason to limit yourself based on language when you’ll definitely adjust. This is especially the case given how many people around the world speak English as a second language.

For example, we mentioned Malaysia above. As part of the former British Empire, English is very widely spoken despite not being an official language, especially in Kuala Lumpur.

But if you’re interested in only those countries where English is an official language, you should turn to the cost of living index we mentioned above provided by the World Population Review.

And if your heart is set on going to Pakistan as the absolute cheapest, it would be a very good idea to check any government travel advisories for Pakistan before packing your bags.

What are the cheapest places to live in the world on the beach?

The cheapest places to livei n the world that also have incredible beaches include:

- Malaysia

- Portugal

- Indonesia

- Spain

- Sri Lanka

- Croatia

- Chile

If you picture yourself living the rest of your days (or even just a few months or years) on a beach, stretching your savings out as long as you can, then finding out the cheapest places to live in the world on a beach is a great place to start.

So this list is based on this article from earlier that set out the 50 cheapest and safest countries to live in. There, you’ll find some postcard perfect beaches at the following, all of which are in the top 15 countries on that list.

2. Figure out what is the cheapest housing option

Another option (that can also be combined with the previous one) is to consider changing what you live in, not only where you live.

That is, many of us live in far more house than we need. In the US, for example, the average size of newly built homes is now 1,000 square feet larger than it was in 1973.

And all that extra space is costing us all a ton of extra money. Not only do you have to pay more rent or more on your mortgage to afford that bigger house, but it also costs more in energy bills, maintenance and land taxes. It’s also the worst way to save money on furniture, given you’re going to have to pay to furnish all that extra space.

This means that downgrading your home as much as possible is going to save you a ton of money over time.

Related: How to Calculate Your Savings Rate – and Why You Should

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

What are the cheapest forms of housing?

The cheapest forms of housing include:

- A shed

- An RV

- A sailboat or a houseboat

- A van

- A bus

- A mobile home

- A tiny house

That is, you have a range of options here for places you can live. If you already have a place that you rent or own, some of these could even be set up in your yard (if you have the space) to sublease or rent out your current house.

And if you think that list sounds a bit odd, they’re all places that other people have lived in either to save money, see more of the world – or both!

But the main point of all these different types of shelter is that they’re much smaller than most of us are used to. At the same time, they’re often all the space you actually need, helping you to save a ton of money on your rent or mortgage

Where can I live for $500 a month?

While there are definitely overseas areas with a lower cost of living,, if you’re planning to stick to the US for now, this article looked into just where you can live for $500 a month:

- West Virginia, where $500 can get you a 1,469 square foot home

- Mississippi, where you can get a 1,379 square foot home for $500

- Alabama, where your $500 monthly payment will buy you 1,308 square feet

- Indiana, where you’ll be able to afford 1,284 square feet with your $500 budget

- Arkansas, where payment for a $500 per month mortgage will get you 1,277 square feet of house

(And if you’re wondering in which country you can live for $500 a month, take a look earlier in this article for the cheapest and safest places to live and work, as you’re likely to find something for that price in some of those.)

The study we just mentioned considered average monthly mortgage payments, home insurance and property taxes.

This means that these states should definitely be on your radar if you’re looking for the cheapest way to live without leaving the US.

Where is the cheapest place to rent in the US?

Apartment Guide undertook a study into where the cheapest places to rent a one-bedroom apartment in the US are. It found that the top five are the following:

- Fort Smith, Arkansas, where your rent will be $466 per month

- Greenville, Texas, where you’ll pay $533 a month

- Texarkana, Arkansas, where you’ll get a one-bedroom apartment for $540 per month

- Russellville, Arkansas, where your monthly rent will be $542

- Indiana, Pennsylvania, where you’ll be paying $554 in monthly rent

What’s the cheapest way to live in a city?

The cheapest way to Iive in a city is to move in with someone else by getting a housemate – or even a roommate if you have enough space and really want to save on living costs. You should also look into moving as far from the city center as your commute allows, based on the available public transport.

The question of how far from the center you can move is probably going to depend largely on how good the public transport is in your city, assuming you don’t want to drive in every day. Alternatively (or as well), if a place is far but with a direct train line, then it should definitely be on your radar.

At the same time, if your city has the infrastructure to allow you to bike in to work or school, then that’s even better!

And on the point of getting a housemate, or even a roommate, it’s not going to be ideal for everyone. But it doesn’t have to be forever; instead, you can consider it a short term arrangement until you’re able to get back on your feet financially.

What’s the cheapest way to live with a family?

If your family can handle living in an RV, a bus or the like, then why not give it a go? Others have done it before you and thrived, so Googling to get their stories could be just the push you need to try it yourself.

It’s going to be harder to consider some of these options if you need more space for your family, but absolutely not impossible. That is, this doesn’t mean you have to just limit yourself to a larger home that may be more than your budget can handle.

At the same time, when looking for the cheapest way to live with a family, moving somewhere with a lower cost of living may be easier than trying to find cheaper accommodation options in your current, presumably more expensive city.

3. Look into any free housing options that may be available to you

Another idea is to look into what free housing options are available to you.

To be clear, we’re not including government-provided housing on this list, but if you believe you qualify, you should definitely look into this.

After all, this service is there to assist people who need the help. If you think that’s you, then please seriously consider this option by getting in contact with a representative from your local public housing association, who will be able to assist.

We’re also not proposing living on the street. While it’s obviously free, it’s also an extremely difficult situation for many who consider it a survival strategy, not a purely money-saving strategy.

So with those out of the way, here are some ideas for how to live without paying rent (or a mortgage).

How do I live rent free?

The most frequent ways to live rent-free involve either living with friends and family for a time or paying for your rent through providing services, rather than just handing money over to a landlord.

The kinds of services you may be able to do in exchange for your living costs include things like cleaning, cooking or other odd jobs relating to maintenance of the home, like looking after the lawn.

Where can I live for free?

These could include:

- Pay your way through offering services. This may involve cleaning, cooking or doing other odd jobs

- Become a live-in nanny, where your rent is included as part of your salary package

- House sit. Some people are away from their homes for months on end as they travel or work elsewhere and are looking for people to watch their homes while they’re away. Which means free rent for you!

- Find a job with a company or other entity that provides housing. This could include working at a boarding house, for a mining or construction company with operations far from any cities or even the military.

4. Create the leanest budget you can

The first step is to figure out the bare minimum amount of money you need to survive by creating the leanest budget possible.

In fact, this is often referred to as a “survival budget”, perhaps for obvious reasons.

This has absolutely no room for any “wants”. Instead, you need to focus just on what you need to survive. So no Netflix, no gym membership and no occasional pizza nights when you can’t be bothered cooking.

That said, most of us are far more inefficient with our money than we should be, meaning that the cheapest way to live on a budget could actually just involve exercising better money management with what we currently have, rather than drastically cutting our expenses.

This template can help you get started in preparing this:

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

How do you live on a tight budget?

Living on a budget as tight as this can definitely be tough.

It’s true that doing a no-spend challenge can be fun for a while and there are a bunch of fun things to do with friends (that are free!) for you to try. That said, it’s not really sustainable in the long term as no one can survive by depriving themselves of any sort of extras for long.

But for the short term – which could even be a few years – living on a tight budget like this could be the difference between whether or not you’re able to get back on your feet financially.

This is why it’s important to always keep your eye on the prize. Maybe this is getting out of debt or saving enough to afford a security deposit to rent a house – or even a deposit to buy one.

Whatever it is, this goal is going to be what you need to keep you motivated during the period that you’re trying to live on your tight budget.

It’s also going to take some super effective money management skills. Often, the best way to do this is to make sure you know where every cent of your money is coming in and out.

And for that, we recommend Personal Capital. It’s a free app with the sole purpose of getting you on the right track financially.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

5. Renegotiate any bills you can’t cancel

If you’re looking for the cheapest way to live, then cutting back on any recurring expenses could make a huge difference in reducing your spending.

But there are some things that you may find that you simply can’t cancel in order to survive, like your energy and water bills.

In those cases, you should shop around to find out what your provider’s competitors offer. Then, you can use that information to negotiate a reduction in your bills – or, if your provider refuses, simply switch.

Most providers know that it costs more for them to attract a new customer than to retain you, so you’re often in a very powerful negotiation position if you try this.

Another tip is to use an app like Trim. It’s a completely free app that renegotiates your bills on your behalf.

It also goes through your account and identifies subscriptions you can cancel – and will then do it for you.

FYI: Grab a free 14-day trial of Trim by signing up here.

It’s one of the easiest ways to save money and takes no time at all.

Another app that can do this is Truebill. Check out our Truebill review to find out more.

6. Use a prepaid cell phone

Many of us sign up for a cell phone contract on the understanding that it’s cheaper over the 24 month period of the contract than paying month to month. Plus, that “free” phone is always a winner.

But have you actually checked how much of your plan you’re using? It’s been found that, in most cases, we barely use all those minutes we’re paying for. In addition, in the time of wifi being everywhere, we often don’t actually need all the data we sign up for.

That’s why switching to a prepaid cell phone can save you literally thousands of dollars over time.

Republic Wireless has particularly good offers that you should look into. They start at $15 per month for unlimited talk and text and you only pay for the data that you actually need.

Republic Wireless

Our pick: Best prepaid phone plans

Of course, the very cheapest way to live is to have no phone at all. At the same time, being disconnected from all the information that’s out there now is arguably no way to live.

This means that if we do consider having a cell phone a necessity, then the very cheapest options out there – like this one – should be on your radar.

7. Switch to fee-free bank accounts

No one should be paying fees to a bank these days when there are so many good fee-free options out there.

We particularly recommend CIT Bank, due to their accounts being completely fee-free with an impressively low minimum deposit.

(They also have some of the best savings accounts in the business, with interest rates that are significantly above the national average – just check out the deal below.)

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

8. Cut up your credit cards

Credit cards can actually be used as a money management tool if used properly. But it takes quite a bit of self-discipline and, if you’re looking for the cheapest way to live, this may be a temptation that you need to avoid.

If this sounds like you, it’s time to simply cut up your cards so that you can no longer use them.

But debt is a killer for anyone trying to save money – which means time to put the cards in the trash.

You may also be interested in: 18 Best Frugal Mom Blogs to Save You Money

9. Focus on destroying your debt

And on that note…destroying your debt may be your very reason for trying to find the cheapest way to live. And if it’s not your goal, it should be.

Let’s be frank for a moment: High-interest debt will always make it impossible to live cheaply. While you still have interest accruing on what you owe, that’s money going to your lender that could be used for much better things.

Which means that all of these efforts to lower your expenses to find the cheapest way to live should be for the benefit of paying off all your debt. The one possible exception is your mortgage, due to the lower interest rates that usually apply.

But all other debt needs to go. Once those repayments are no longer hanging over your head, you’ll see your monthly expenses immediately lighten.

10. Look into your energy usage

We mentioned above that you should always try to negotiate a better deal with your energy and other providers, but you can also look into how to cut expenses on things like this at the usage end.

This could be as simple as turning off the lights in rooms that you’re not in or lowering the thermostat and putting on a sweater instead.

Even just lowering the heat or the cool at night while you’re asleep can save hundreds of dollars each year.

It’s also worth looking into whether the things you earn are sucking up more energy – and money – than you realize. For example, a really simple idea is to switch out your light bulbs for more energy efficient ones.

These energy efficient light bulbs are hugely popular on Amazon given that they last far longer and use way less energy than standard bulbs.

11. Use cash back apps

The first trick for anyone looking to save money on their food costs is to make sure you’re using a cash back app.

The best in the business is definitely Ibotta. They offer cash back at over 500,000 retailers on almost anything you buy, such as groceries, medicine and clothing.

Plus their free $20 welcome bonus is flat-out incredible.

Saving money on things you’re already buying is ideal, as it requires zero extra effort in order to get this cash, which is why using a cash back app is one of the easiest ways out there to save money.

Ibotta

Free sign-up bonus: $20

Ibotta’s a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

In fact, users make $150 per year on average – not including your free $20 welcome bonus – with over $682 million having been paid out, so you know Ibotta is definitely legit.

12. Meal plan based on cheap ingredients

Meal planning with frugal meals is a great way to save money on food costs, as it makes sure you’re basing your meals around the cheapest ingredients available.

Plus, there’s never any thought required as to what’s on the menu for dinner tonight – which can lead to everyone just deciding to get costly takeout.

In particular, reducing your meat consumption by planning meals around cheap food ideas like beans and legumes will not only save you a ton of money, it’s also super healthy and good for the environment.

And if all that sounds too hard, we’d strongly recommend you look into the service offered by $5 Meal Plan.

For only $5 per month, they’ll send you weekly meal plans where the average cost of each meal is less than $2 per person.

While it may seem strange to suggest spending money when you’re trying to find the cheapest way to live, this small $5 investment will save you hundreds of dollars every month – especially if you know you’re not the kind of person who has the time or energy to bother meal planning yourself.

FYI: Try out the 14-day free trial of $5 Meal Plan here to see if it works for you.

13. Always use a shopping list

Entering a supermarket without a shopping list is a recipe for spending more than you planned.

This is because you’ll either find yourself buying extra things that you “might” need or forgetting something and having to go back, increasing your chance of spending more on your return trip.

Instead, only using a shopping list – and actually sticking to it – is a super easy way to save money.

Plus, if you’re already meal planning, it’s going to be crazy easy to prepare a shopping list based on this.

14. Buy in bulk

Buying non-perishables in bulk is a no brainer for anyone looking to save money.

Of course, this will depend on you having the storage space to keep these items. But if that’s an option for you, making sure you have things like rice and beans always on hand will make it much more likely that you end up cooking with them – saving even more money over time.

Related: Why Living Stingy Could Be The Key To Achieving All Your Financial Goals

15. Don’t eat out

It’s hardly surprising to hear that eating out is going to cost a ton more than if you simply made your meals at home.

This is why anyone looking for the cheapest way to live has to avoid eating out (including getting takeout) at all costs.

Meal prepping – or making your meals in advance and freezing them – can be a good way to avoid this, as it ensures that you always have prepared meals on hand for those nights where you just can’t be bothered cooking.

16. Avoid convenience foods

Convenience foods that you just pop in the oven to make can sometimes seem like a good deal, but you may be ignoring just how expensive these can be.

Given the amount of food you’re getting, it’s always going to be cheaper to make the meal yourself.

Plus, they’re often loaded with salt. So while you may think you’re saving money on food, those added healthcare costs could come back to bite you later.

Instead, as mentioned above, consider meal prepping. It’s like having your own convenience food available at all times, except you know exactly what’s in it and will cost you a fraction of the price overall.

17. Sell any cars your own

For those trying to implement the very cheapest way to live, getting rid of your cars has to be on the list.

This can be tricky for those of us who are used to always having a car on hand. But at the end of the day, they’re a convenience item.

And, like with houses, most of us have far more car than we actually need.

Selling your car should be even higher on the agenda if you have a loan. Not paying cash for your car is one of the biggest money mistakes that many people make.

Just think about it: it’s a depreciating asset on which you’re paying interest. It’s like a double loss.

So it’s time to sell the car and look into some of the other alternatives below.

When selling your car may not be the best idea

There are some times when selling your car may not be the best plan, which mainly involve when you absolutely need your car to continue to make money or for health reasons.

For example, if you need it for your job, then keeping one (and only one!) car per household may be worthwhile.

However, in those cases, you should seriously look into downgrading your car as much as possible.

Finding a smaller, second hand car will save you a significant amount on running costs, insurance and, depending on the brand, maintenance fees.

So do the math to see what works for you.

And remember: if you only need a car from time to time, services like those offered by Uber or even companies that let you rent a car by the hour will end up being far cheaper over time than having to pay for your own car.

18. Use a bike

Using a bike is one of the cheapest ways possible to get around. Once you’ve bought the bike, that’s basically the end of your costs except for the occasional repair that you can’t do yourself.

Many of us have relied on having a car for so long that we don’t even consider the fact that a bike is a very viable alternative, especially for getting to any destination that’s around 6 miles from our starting point.

19. Walk

And an even cheaper option is walking. Not only is it obviously free, but the health benefits could save you money in the long run.

Of course, this may not always be possible, such as if you live far away from your destination and public transport isn’t great in your area.

But if it’s at all a possibility, then throw on a podcast, make sure your clothes are weather-appropriate and start pounding the pavement. Your wallet and body will thank you.

20. Car pool

One way to get to work once you’ve sold your cars is to carpool with other people.

By chipping in for the gas with some colleagues – or even complete strangers going roughly the same direction as you – you’ll spend far less than if you drove yourself.

Not to mention that it’s far better for the environment.

21. Take public transport

It may sound obvious, but many people don’t even consider taking public transport once they’ve had a car for a while.

But not only is it cheaper than operating a car, it’s often faster for getting from A to B. After all, you don’t have to find a parking space and don’t (usually) have to battle traffic.

You also don’t have to pay to maintain a subway car or a bus – an added benefit compared to using a car.

Are these also the cheapest ways to live in retirement?

If you’re specifically looking for the cheapest way to live in retirement, then most of these tips will also apply to you.

For example, no matter where you are in life, a smaller house will always cost you less. And things like meal planning or downgrading your car to only what you need are all great money management tips whether you’ve just entered or just left your working life.

Where can I retire cheaply?

We’ve all heard the stories of people moving to different countries to spend their retirement on a beach – at a fraction of what it would have cost to do the same thing in their home country.

This means that the list of the cheapest and safest countries to live in earlier in this article would all offer great retirement locations as well.

Of course, whether you’re planning to move somewhere to work or to never work again, you’ll have to look into the visa situation to see if you’re actually allowed to live there.

And when looking for somewhere where you can retire cheaply, just make sure that the options you’re considering offer everything that you need, not only a cheaper way of life.

For example, good healthcare services or proximity to a well-connected airport could be additional considerations.

Final thoughts on the cheapest way to live

Cutting expenses in your major budget categories, such as housing, is imperative for anyone looking to save money.

This is especially the case when we consider how much most people waste on things like this, such as living in much larger houses than we actually need.

It’s also worth considering the other benefits of living in a country with a lower cost of living – outside of the financial advantages.

A new culture, a new language, great food, amazing new travel opportunities…all of these could be on offer while you save money.

That said, if this isn’t an option for you, there are plenty of other tips on this list that you can implement in your life to bring your day-to-day costs way down.

Even if it’s just for the short term to reach a specific financial goal, implementing even just some of these will be more than worth it.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.