If you’re wondering how to start saving for Christmas, having a solid Christmas savings plan can really help.

After all, there’s no question that the holidays can be the most expensive time of the year. This means that it can be a real struggle financially for many of us, especially as we’re bombarded with ads telling us that we can only have the perfect Christmas if we spend as much money as possible.

Safe to say, this isn’t true. But by being prepared for the holidays by putting a monthly or weekly Christmas saving plan in place, you’ll be able to make sure your budget can easily cope with these end-of-year expenses.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

How to start your Christmas savings plan

1. Choose your format

Much like living on a budget, having a Christmas saving plan set out clearly in front of you makes it much easier for you to see just what you need to do in order to reach your savings goals by the time the holidays roll around.

That is, deciding that you want to save $1000 for Christmas is all well and good, but just having that as your plan in your mind can make it seem insurmountable. Instead, it’s much easier to figure out that you need to save $83 every week for the next 12 weeks in order to have that much money by December 25th – and then write it down.

Whether you choose to use a Christmas savings plan template for this or a simple notepad, having each week’s goal clearly written down for you to have a clear aim when you start saving money for Christmas weekly for will make it much easier for you to see if you’re on track or not.

2. Work out how much you want to save

The first step of any goal is, perhaps obviously, working out exactly what that goal is. And in this case, that involves figuring out how much you want to save for Christmas this year.

Related: 13 Proven Tips to Save $1,000 a Month

How much money should you save for Christmas?

You should only save as much for Christmas as you think you’ll need and that you can afford without putting yourself into debt.

It’s important to keep in mind that Christmas really is only one day of the year. While the ideal holiday season promoted by every movie we’ve ever seen may sound great in theory, you should definitely not put yourself into debt in order to afford this. And while you may think that you can drastically cut expenses to help you do this, ask yourself if that’s actually realistic at this time of year in particular – especially if this isn’t your usual spending habits.

This is why I’d recommend being as conservative as possible when setting a Christmas savings goal. While it would be great to have enough to afford every present on everyone’s list for Santa, this definitely isn’t strictly necessary in order to still have an amazing Christmas.

(It’s also a good idea to calculate your savings rate during the rest of the year, to have a Christmas savings goal in mind that you’re actually likely to achieve.)

3. Open a Christmas savings account

To make sure you’re sticking to your Christmas saving plan, consider opening a separate Christmas savings account for you to safely store your money until you need it for the holidays.

That way, by keeping it separate from your other funds, you won’t be tempted to use these savings on other things in the lead up to the holidays.

Talk with your bank to see what fee-free extra account options are available for you. And if you’re looking for a completely free high interest savings account, whether it be for a Christmas savings account or to keep your money all year round, we definitely recommend checking out CIT Bank.

Not only are they completely free, but they offer some of the best interest rates in the market.

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

4. Prepare a meal plan for the entire holiday season

Food is one of the biggest parts of any household budget and Christmas is definitely no different.

This is why one of the best ways to save money at any time of the year is to always have a meal plan – ideally based around some of these cheap food ideas.

Managing your food spending is one of the best strategies if you’re looking to live cheap, with meal planning being one of the top ways to do this. After all, it means that you’re able to use the food that you already have as cost effectively as possible. At the same time, you’re also able to make sure that your trips to the supermarket only involve you buying exactly what you need – no more, no less.

This is why having a meal plan can save you hundreds of dollars every month, but especially at Christmas when so much of the season revolves around eating. And you can make this extra money savvy by focusing it only on frugal meals.

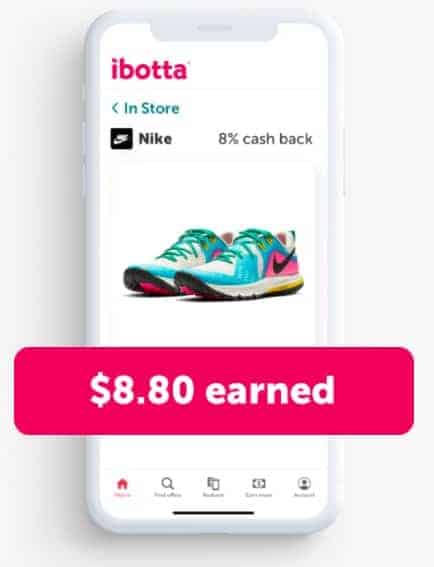

It’s also for this reason that we always recommend that you take advantage of cashback offers on your groceries. Ibotta easily offers some of the best deals for this, providing you with money back on things you bought over 500,000 partner retailers.

(You can also use this to get money back on everything else you’re buying over the holiday season too!)

And you can start by getting their pretty amazing $20 free welcome bonus by signing up here.

Ibotta

Free sign-up bonus: $20

Ibotta is a completely free app that gives you cash back on what you’re buying already – groceries, medicine, clothes and more.

In fact, users make $150 per year on average – not including your free $20 welcome bonus – with over $682 million having been paid out, so you know Ibotta is definitely legit.

5. Start looking for Christmas gifts now

You won’t be surprised to hear that the cost of gifts definitely goes up as Christmas approaches. And while you can take advantage of Black Friday sales (or cash back offers, like we just mentioned with Ibotta), there are actually even more cost effective ways in order to get people gifts for Christmas.

A great place to start is our article on cheap homemade Christmas gifts.

Alternatively, start checking out thrift stores in your local area as early as possible, because you’re definitely not going to be the only person to have this idea.

You’ll be amazed what you can find there too, with people often dropping off toys that are close to brand new, clothes that have barely been worn or may even still have the tags on, as well as other knick knacks that can easily fill a Christmas stocking at an amazing price.

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

It can also be a good idea to consider gift options that are completely free. There are plenty of tips on sites like Pinterest and YouTube on how to DIY Christmas presents, but there are also other ways to get completely free gifts as you can see in the following articles:

- 43 Simple Ways to Get Free Books Mailed to Your Home

- 12 Simple Ways To Get Free Shoes Sent To Your Door

- 17 Easy Ways to Get Furniture for Free

Remember: the best Christmas gifts are rarely the most expensive ones.

And if it’s truly outside of your budget, there’s nothing wrong with not being able to afford presents this year. Instead, why not offer an experience, like a camping trip in your living room with your kids, an at-home spa session for your partner or a restaurant-quality dinner for your parents at their house.

These can definitely be just as fun – and arguably even more memorable.

(This list of fun things to do with friends for free should provide some great inspiration!)

When should I start shopping for Christmas?

You should start shopping for Christmas as early as possible, including even the day after the previous Christmas Day to take advantage of great sales. This is the perfect time to buy heavily reduced Christmas items, like decorations, but also gifts that are able to be hidden for the next months and put under the tree next year.

6. Get a Christmas side hustle

When looking to commit to a Christmas saving plan, one of the best ways to achieve this saving goal may not actually be only to save money, but to make more money that you can then funnel straight into your new Christmas savings account.

And there are plenty of ways to make extra money over the Christmas season. Some of these include:

- Getting a part-time seasonal job. The lead up to the holiday season is one of the busiest periods of the year for most retailers, which is why many of them hire people specifically for the holiday season. Companies like Target and Walmart often have this, so keep an eye on some of the major stores in your area to see what may be on offer.

- Creating and selling Christmas items. If you have a creative streak, you should definitely consider harnessing this to make some money for Christmas. This could be something as simple as making Christmas decorations or Christmas-themed jewelry to sell at local markets or on line on Etsy, creating Christmas desserts that you can then advertise for people in local Facebook groups, or even non-festive items that people could use as gifts.

- Making money from people’s Christmas vacations. As Christmas is a prime travel period for most people, this can offer a perfect money making opportunity for you. For example do you have any spare rooms in your house – or are you planning to travel yourself so your house is free? Consider advertising it on Airbnb. Another idea is to offer to pet sit while people travel for the holidays, which is a really easy way to make money, especially if you love animals.

7. Consider joining a Christmas Club

Joining a Christmas club can be a great way to set aside enough money throughout the year to make sure you can afford the Christmas you’ve been dreaming of.

This may be in the form of an employee Christmas savings scheme, where your employer sets aside some of your income each month into a specific account. You’ll then receive the accumulated total around November.

If this isn’t available to you through your employer, you can also check out any credit union Christmas savings programs that are on offer. They basically work the same as an automated savings account, with regular transfers being taken from your main account and put into the separate Christmas Club savings account.

What is a Christmas Club savings account?

A Christmas Club savings account is sometimes called a holiday club account, and is one where you make regular contributions throughout the year. The total amount of savings are then withdrawn close to Christmas to help people pay for their Christmas expenses.

Of course, you can do the same thing with a standard high-interest savings account that you treat as a Christmas Club savings account by only touching the money for holiday-related expenses. Like the one we recommended earlier from CIT Bank, these also typically offer higher interest rates than a Christmas-specific account.

Can you withdraw money from a Christmas club account?

You can withdraw money from a Christmas club account, but doing so too early can lead to you incurring a penalty fee depending on the exact terms of the account.

This can be problematic if, say, you see a new toy for someone’s gift that’s released in July but that may be sold out by November. In that case, you may wish to withdraw some of your Christmas club money, but the fee may make it not worthwhile.

One way to help you with this is to keep your money in a short term certificate of deposit (CD). These are accounts that pay you higher interest rates on the understanding that you won’t touch your money for a set period of time.

To see how to find the best CD for you, check out our SaveBetter review.

How do I start saving for Christmas?

The best way to start saving for Christmas is to put a Christmas saving plan in place, see where you can begin to make cuts to your expenses and start contributing to your Christmas savings as soon as you can.

And the earlier you start saving money for Christmas weekly (or monthly, if you prefer), the easier it will be to reach your savings goals.

That said, if Christmas is just around the corner and your savings aren’t where they should be, all is not lost. In that situation, it’s important to have a reasonable saving goal which, as mentioned earlier, doesn’t mean that you’re going into debt just for Christmas.

Like most savings goals, the first step is to create a budget. By knowing just where your money is going, you’ll be able to see where your money is going as well as where you could be spending more effectively. In this way, you’ll be able to make sure as much money as possible is being put towards your financial objectives.

Related: 10 Easy No-Spend Challenge Ideas to Save Money

How can I save $1000 for Christmas?

You can save $1000 for Christmas through either reducing your spending, increasing your income or a combination of both. It also depends on how early you start. For example, starting in January means you only need to save $20 a week, while starting in September means saving $77 a week.

The tips listed in this article will make it easy to do some or all of these things. But it will also depend on when you’re starting – which is why you should save money beginning as early as possible.

For example, when planning on saving money for Christmas weekly:

- If it’s January 1st and you want to save $1,000 for Christmas at the end of the year, you’ll only have to save $20 per week

- If, however, it’s six months until Christmas, you’ll have to save $39 a week to have $1,000 for Christmas

- On the other hand, if it’s three months until Christmas, you’ll have to save $77 per week to make sure you can save $1,000 for Christmas

- And if Christmas is one month away, saving $1,000 will require you to save $250 every week for the next four weeks

Obviously some of these are going to be easier than others. So if you haven’t started earlier enough to have a realistic saving goal, perhaps seeing where you can make cuts to your planned holiday expenses (including by embracing the art of living stingy with style!) is a better Christmas saving plan.

Final thoughts on having a Christmas savings plan

Having a saving plan at any time of the year is a good idea if you have financial goals, which is why having a Christmas saving plan could be the perfect solution for your household.

By consistently adding money to your Christmas savings account, you’ll be able to ensure that you’re financially prepared for the often crazy expensive holiday season.

And while having a picture perfect Christmas may be a dream for you, you shouldn’t struggle financially to afford it. So while it’s great to learn how to start saving for Christmas to save as much as you can, don’t overburden yourself in order to do so.

Finding that balance will help to make sure that everyone – especially you – really does have a very merry Christmas.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.