So you know you’re supposed to start a budget. But figuring out how to divide up your money into household budget percentages can be straight up impossible to figure out.

How much should you be allocating to food? And are you allowed to spend anything on entertainment or does every single cent have to go towards your savings?

This is why having some guidance on how to actually do percentage based budgeting can really help you to create the ideal household budget for you.

Personal Capital

Our pick: Best budgeting app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

Of course, these can be flexible depending on your own personal circumstances – to a point.

For example, what percentage of your budget should housing be may vary depending on your financial goals and what you choose to prioritize in your budget.

But, in general, following these recommended budget percentages is a great way to make sure your money is being allocated as effectively as possible – including to pay off your debt, grow your savings and start setting yourself up for retirement.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

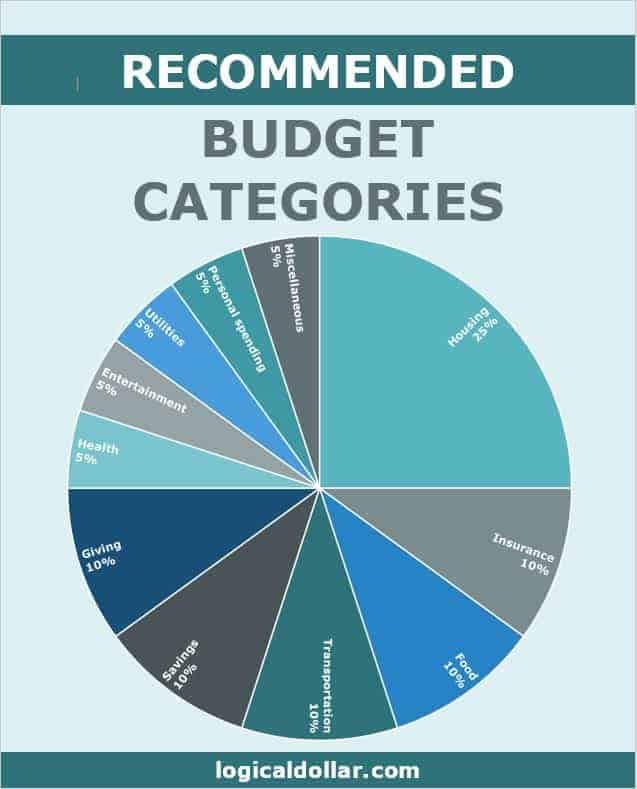

What are the recommended household budget percentages?

These recommended household budget percentages are from a list that was originally created by Dave Ramsey.

They follow the concept of the zero-based budgeting method, which involves making sure that every dollar has a job. This lets you keep track of exactly where every cent that comes into your account is going out.

And the percentages themselves are as follows:

- Housing: 25%

- Insurance: 10%-25%

- Food: 10%-15%

- Transportation: 10%

- Saving: 10%

- Giving: 10%

- Health: 5%-10%

- Entertainment: 5%-10%

- Utilities: 5%-10%

- Personal spending: 5%-10%

- Miscellaneous: 5%-10%

It’s important to remember that these are only recommended household budget percentages. So if you need to adjust them slightly to suit your personal circumstances, that should be fine.

Just make sure though that any adjustments that you make are in line with your financial goals. For example, if you want to plough more than 10% of your income into your savings, then that’s great!

If, however, you want to keep getting take out a few nights each week and allocating 10% to 15% of your budget on food isn’t going to be enough to cover that, you should really reconsider your spending habits.

And if you’re still not sure what household expenses to include in what category, it’s not the end of the world. As long as they’re put somewhere so your spending of every dollar is accounted for, that’s the most important part.

And one final point: don’t forget that these percentages are based on your after-tax income.

What do the household budget categories consist of?

You probably have a ton of different expenses in your daily life and simply having that list above may make it hard to see just how to divide your spending up between each of those categories.

For example, if you like to eat out from time to time, should this count as food spending or fun spending?

So this is why basing your budget on these broad household budget categories can be a good place to start:

Housing

This includes your rent or mortgage repayments, related taxes, maintenance fees and homeowners association costs

Insurance

This category covers all insurance premiums you owe, including health insurance, auto insurance, homeowner’s or renter’s insurance, life insurance and so on

Food

Any costs relating to what you eat should go here, meaning that it includes both grocery expenses and the cost of eating out.

Transportation

All expenses relating to how you get from A to B will fall under this category. This includes all public transport costs as well as expenses involved in owning a car except for insurance, such as maintenance, gas, parking and vehicle registration.

MANAGE YOUR MONEY LIKE A BOSS

Managing your money effectively can literally change your life. And starting a budget using our budget planner is the first step towards you doing just that.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

Saving

You should be allocating money to your financial goals every month, so this is the budget category for that. Don’t be fooled by the name though – it doesn’t only cover your savings but also things like paying off debt and contributing to retirement funds.

Giving

It’s a good idea to assign some of your budget towards helping others, if you can. Whether you choose to give to charity or through your preferred religious community, allocating some money to this category can be a great reminder of what you do have, even as you may be dealing with some of your own money issues

Health

This is for all health costs except your health insurance. Of course, this may fluctuate depending on what happens to your household in a particular month, but it’s always a good idea to set some money aside for the unexpected.

Entertainment

It’s fine to make sure you’re having some fun while working on your finances, so this budget category is for those things. It includes concerts, trips to the cinema, gym memberships, club fees and so on.

Utilities

This includes all those services that you have to pay for in your life, so would cover electricity, water, gas, trash services, internet and your phone plan.

Personal spending

These are for those extras that pop up from time to time. Managing your money shouldn’t be a complete grind, so this category will help make sure you can grab the odd treat.

After all, you’re crushing your financial goals so you deserve a reward, right?

Miscellaneous

It’s always good to have a buffer, so this is for those random expenses that occasionally appear but that may not fit into one of the other categories on this list.. It can also help if you happen to go over one of the other household budget percentages.

What about within those overall budget categories?

How you spend the allocated amounts within each of those overall budget categories is largely up to you – as long as you stick to the spending cap on each category.

So if you’re wondering what percentage of your budget is for clothes, for example, the most important thing is to make sure that whatever you spend is within your personal spending percentage of 5% to 10%.

What are the benefits of household budget percentages?

Using household budget percentages as your budgeting method of choice is a great way for those looking to take control of their money.

This is because it’s forcing you to pay attention to where your money is coming in and, importantly, going out.

Many people aren’t completely aware of where their money ends up each month, which is often what gets them into trouble as their spending spirals out of control. It’s also what leads to many of them not being able to achieve any of their financial goals.

Instead, by relying on a percentage-based system to do your budget, you’re giving yourself the chance to see where you might be overspending in certain areas, letting you adjust accordingly

And the benefit of these specific household budget percentages is that they’re still letting you live your life.

Many budgets force you to consider what are basic living expenses and not spend a cent on anything else. Realistically, though, this isn’t going to be sustainable in the long term.

This method, on the other hand, gives you the freedom to have a life (within reason) while encouraging you to take control of your money.

What is an ideal household budget?

Broadly speaking, the answer to the question of “what is an ideal budget” is: any budget you’ll actually stick to.

So your ideal household budget is one that works for your household while also helping you work towards conquering your financial goals.

This is why the flexibility in these household budget percentages work well: they let you have some leeway if you need it, but only within reason.

And as mentioned, they can also be adjusted if needed – although you have to be careful which way you go on this.

How to determine the best household budget percentages for me?

The question of what are good budget percentages can be answered similarly to something mentioned earlier. That is, they’re going to be the percentages:

- That work for your personal circumstances (even though you may have to change some of your spending habits)

- That you’ll actually stick to

- That contribute towards achieving your financial goals

- That only allow for deviations from the recommended household budget percentages if absolutely needed

For example, if someone in your household is sick one month, your health costs for that month might have to go above 10%. And that’s fine as, with percentage-based budgeting, you should have the flexibility to cover this from other categories.

However, it’s worth taking another look at your spending if you find your percentages shifting to meet your “wants”.

This means that, say, some entertainment expenses are fine. But if you realize you’re going above 10% of your budget each month on this? It’s probably time to reevaluate how you’re using your money in this category rather than trying to make it work by allocating less to other categories – especially if it involves cutting back on your savings.

You can use Google to find a budget percentages calculator to help you see what your spending cap in each budget category is going to be – or just do it individually, the old fashioned way.

What about debt?

Debt is one of the best reasons for you to start a budget. At the same time, it’s one of the main reasons that people struggle to stick to these household budget percentages.

It’s also why I often recommend that people increase the amount they’re allocating to the savings category. That way, there’ll be enough money to both grow your savings and pay off some of your debt.

It can also be a good reason for people to stick to the lower end of these percentages. That is, while you may be allowed to spend 5% to 10% of your budget on recreation, you should try to stay as close as possible to 5% to make sure as much money as possible is being used to get you out of debt.

This is why cutting your “wants” as much as you can when you have debt is key to getting you out of that situation.

Sure, it’s not as fun. But the sooner you focus every spare dollar to paying your debt off, the sooner you’ll be free of that shadow looming over your finances.

A sample budget for a family of 3

Let’s look at a sample budget for a family of three to get an idea of how this would work in practice. We’ll assume they have the US median household income of $63,179 and pay the average individual income tax rate of 14.2%.

This means their take home pay is $54,207.58 annually or $4,517.30 per month – which we’ll round down to $4,500 to make the calculation easier.

We’ll also assume that they’re using the lower amount of each of the sample household budget percentages.

This means their monthly budget would be divided as follows:

- Housing (25%): $1,125

- Insurance (10%): $450

- Food (10%): $450

- Transportation (10%): $450

- Saving (10%): $450

- Giving (10%): $450

- Health (5%): $225

- Entertainment (5%): $225

- Utilities (5%): $225

- Personal spending (5%): $225

- Miscellaneous (5%): $225

So for a family of three, this would mean that they would have $37.50 per person to spend each week on food. You can probably see how this would make eating out difficult.

At the same time, assuming this is two parents and a child, maybe their child gets a free school bus to school, one parent works from home and the other takes the train to work. Depending on where they live, this could easily cost less than $450 each month, allowing them to allocate the leftover money to, say, their savings.

Then, at the end of the month, they would add up how much they spent in each overall budget category and compare it against these amounts.

If they spent less, perfect! But if they over-spent, that would be the time to look into exactly what happened and see how to adjust their spending habits for the next month.

What budgeting method should I use?

There are a ton of budgeting methods out there, each of which have their pros and cons based on the kind of person you are and where you are on your money management journey.

As mentioned earlier, the idea of using these household budget percentages is based on the zero-based budgeting method.

That said, there are other budgeting methods that rely on percentages in different ways.

What is the 50/20/30 budgeting rule?

The 50/20/30 budgeting rule also uses percentages, but in a far simpler way.

Using this budget method, you’d allocate your money into the following budget categories:

- 50% needs: These are things that you absolutely have to pay, no matter what. This could include things like rent or your mortgage, grocery costs, insurance and utilities.

- 20% goals: These are the funds you’ll be allocating towards your financial goals. Looking to increase your savings, pay off debt (except your mortgage) or contribute towards your investments? This is where that money comes from.

- 30% wants: These are the things that make life just that little bit nicer – but that you could live without, if needed. For example, grocery costs come under “needs” but if you like to eat out from time to time, use the money in this pot.

The main advantages of this budgeting method is its simplicity. That is, it works like the household budget percentages in that it forces you to consider where every dollar is going – but with far less detail.

But what is the 30% rule in practice?

The biggest problem that people usually have with the 50/20/30 budget rule is confusing wants with needs.

They may find that spending only 30% of their budget on wants isn’t enough so – accidentally, of course – that new shirt they had to have or that night out at the newest restaurant in town suddenly get allocated to the “needs” part of their budget.

But as with all budgets, this simply requires some self-discipline to manage.

So would you die without that shirt or if you didn’t go out for dinner? Probably not – which means it’s probably not actually a “need”.

What is the 70/20/10 rule for your money?

This is similar to the 50/20/30 rule in practice, although involves thinking about your budget allocations in a slightly different way.

That is, the 70/20/10 rule for your money involves dividing your after tax income as follows:

- 70% for living expenses: This covers everything you spend in your day to day life. Bills, rent/mortgage, clothes, food, entertainment – if you spend money on it, it goes here.

- 20% for savings: This isn’t like the other budgeting methods above where “savings” actually means “all financial goals”. Instead, this money should be sent straight to a savings account and not touched.

- 10% for debt: This should be immediately put towards any debt you hold – preferably on the day you’re paid so you know that it’s covered.

As you can see, this doesn’t require you to differentiate between your “wants” and your “needs”, although you may find that you have to if your spending is creeping up towards (or, worse, over) the 70% mark.

At the same time, it does involve you allocating a bit more towards your financial goals.

And if you don’t have any debt, well done – feel free to put that money towards your savings instead!

What is the 28/36 rule?

You may need to pull the calculator out for this one as the percentages aren’t as straightforward as the other budgeting methods.

However, it’s a good rule to be aware of if you’re considering applying for some type of credit. This is because the 28/36 rule is relied on by mortgage lenders and other creditors to determine your borrowing capacity.

This means that if you think you’ll be borrowing money soon, it can be a good idea to align your budget to this rule now.

How it works is that a household should spend up to 28% of its pre-tax monthly income on housing expenses and a maximum of 36% on all debt obligations.

So to use the example of a household earning $5,000 per month (before tax), they could spend up to $1,400 on housing costs and a total of $1,800 on all debt, meaning they would have $400 to spend on non-mortgage loan repayments.

How do I make a budget that works?

We’ve covered this earlier but it’s worth repeating: the best budget for you is one you stick to (and that helps you reach your financial goals).

And for tips on how to stick to your budget, we’ve got you covered.

(You could even make it easier on yourself by using a budget planner to help you get financially organized.)

Tips on how to stick to your budget

1. Use a budgeting app

There are plenty of budgeting apps out there, many of which are free or low-cost and that can be connected to your bank accounts to track your spending automatically.

And this makes them a great option for people who are finding it hard to track their spending. As the app does all the hard work for you, you’ll have no excuse but to stick to your budget!

2. Make sure everyone in your household is on board

One of the most frustrating things when trying to take control of your money is when you feel yourself taking great steps in the right direction – then someone else in your household undoes everything.

So before embarking on a new budget, it’s good to have a serious talk with everyone else to make sure they’re on board. These aren’t always the nicest conversations, especially if the other person has some of their own financial issues to work out.

But by starting this together, including establishing shared financial goals for everyone to work towards, you’re far more likely to be able to stick to your new budget.

3. Set up automatic transfers where you can

A great tip for anyone trying to stick to their budget is to take advantage of the magic of automatic transfers.

That is, by setting up your banking so all your money to be allocated to savings and debt repayments is transferred out the day your salary hits your accounts, you’ll immediately know they’re taken care of.

And that means that everything left over in your account can be put towards your other expenses.

4. Be realistic

It’s all well and good to decide you’re going to crush your debt, but set yourself a realistic timeline in which to achieve this.

For example, if you find yourself struggling to save anything at the end of each month but you want to pay off $1,000 in credit card debt, it’s likely going to be more reasonable for you to aim to pay off $200 of this every month rather than immediately cutting your spending by $1,000.

By setting goals you can actually achieve, you’re not setting yourself up for failure. And when you reach that initial goal, the motivation will be hugely helpful for climbing your next money mountain.

And the next and the next and the next!

What should a monthly budget include?

When setting your budget for the upcoming month, you should include everything you possibly can on there as part of your budget plan.

(To make it easier on yourself, you might consider using one of these free budget printables, many of which already have the different types of expenses listed for you.

It’s better to be over-prepared than under-prepared. For example, if you think your car might need some repairs soon but aren’t sure if it will be this month or if it can wait a bit longer, it’s much better to allocate some money to that in this monthly budget.

And then, if your car survives longer than you expected, that unused money will give you some breathing space.

Similarly, at the end of the month when figuring out how well you’ve stuck to your budget, you need to be including every single expense you’ve incurred.

No leaving off that beer you had on Friday afternoon with your colleagues because “it was just one”. Don’t ignore that one pair of shoes you bought because “you really needed them for work”.

Everything should be put on there so you have an accurate snapshot of how you’ve been managing your finances. Otherwise, you’re just cheating yourself.

Related: 20 Best Books About Budgeting (That You Need to Read)

How to create a budget with irregular or fluctuating income?

If you have an irregular or fluctuating income, it’s true that it can be harder to create a monthly budget.

The best way to do this is to figure out what you need to spend to survive. This “bare bones budget” will set the baseline for how much you really, truly need to spend and is the number on which you should base your budget.

You can then add “wants” but be sure to keep an eye on these over the month. You’ll also probably have to adjust more frequently than someone with a more regular income, especially once you have an idea if this month’s earnings are going to be higher or lower than usual.

Final thoughts

Budgeting is one of the best things you can do for getting your finances under control and these household budget percentages may be just what you need to create your very first budget – that you’ll actually stick to.

And as you continue and get better at managing your spending, you’ll see yourself also get better and better at working towards achieving your financial goals.

Whether it’s paying off debt, setting up your emergency fund or contributing to your 401(k), following a budget is one of the most effective ways to contribute to these, making sure that you’re doing everything you can to secure your financial future.

READY FOR MORE?

Join thousands of subscribers in getting regular tips in your inbox on how to take control of your finances and save more money – and, for a limited time, get our free budget planner as a gift!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.