Despite how it may feel when you’re struggling to make it to your next paycheck, there are actually plenty of people who have figured out how to get rich from nothing.

And the answer isn’t simply to win the lottery. Instead, studies have actually found some common factors for those who built their wealth themselves, without any help from, say, an inheritance.

And this is great news for you! What this means is that basically anyone can put the same factors into play in their own lives, as part of the strategy to become rich even with no money as their starting point.

To be clear, this isn’t a discussion on how to get rich fast. Anyone trying to sell you on that line probably doesn’t know what they’re talking about…or is trying to rip you off.

But by having a plan and committing to it over the long term, you’ll see it’s entirely possible to start at zero and eventually get to seven figures – if not much, much more.

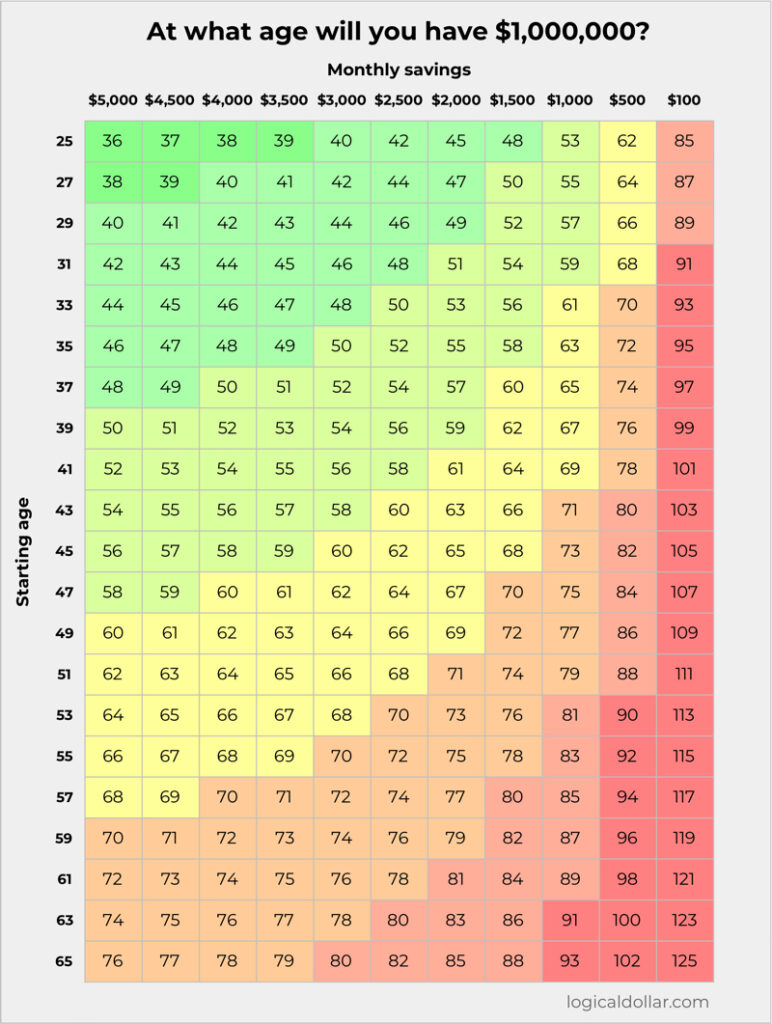

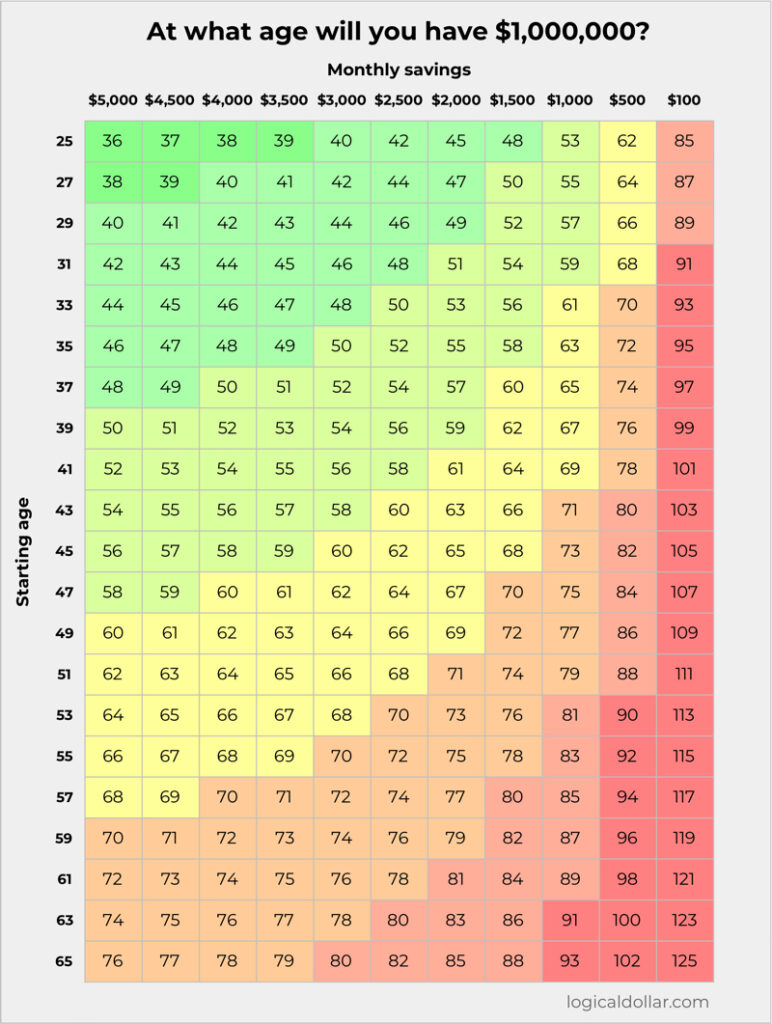

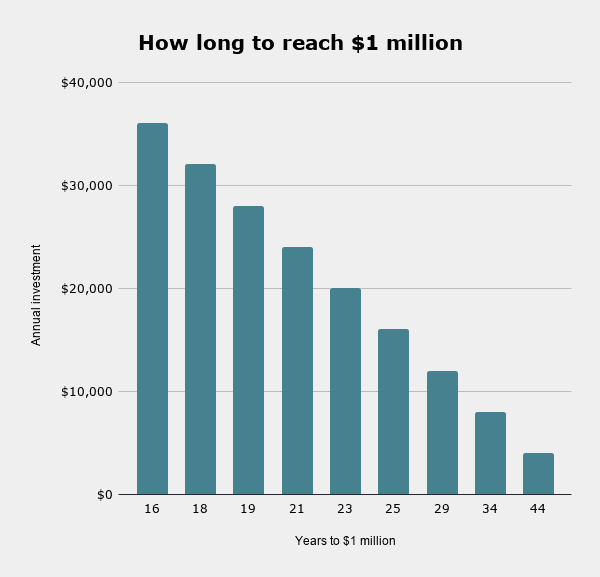

After all, just take a look at this table for how you can become a millionaire, as the math doesn’t lie (based on an average annual return of 7%):

How to get rich from nothing

It’s more than possible to get rich from nothing by implementing a few key points that have worked time and time again. Namely:

- Control your spending

- Get into the right mindset

- Commit for the long haul

- Pay off debt

- Set clear, actionable goals

- Start investing as early as possible

- Keep learning

- Build up your income

- Automate your finances

- Stay the course

We’ll go into each of these in more detail below. But given that most millionaires around the world didn’t inherit their money, studies have found that these are the common ways that people have used to build their wealth.

This means that becoming rich with no money isn’t something only for the Mark Zuckerbergs of the world.

In fact, there’s a book that shows just how simple it is for normal, everyday people to build wealth, based on what others have done before them.

The Millionaire Next Door is one of the major books in the personal finance world (and one I’d definitely recommend to anyone). It sets out the authors’ findings based on research into the profiles of almost 300 millionaires in the US.

What they noticed is that most millionaires are actually found in middle class, blue-collar neighborhoods, rather than the more affluent communities you’d expect to find them in.

In particular, the book finds that more millionaires achieved their seven-figure net worth by earning an average salary. This is largely based on the fact that high income professionals are often more likely to spend their money on luxury goods rather than saving and investing.

The good news for you is that the book broke this down even further to identify seven key factors that are common to the millionaires they profiled.

We’ll go into these later in this article. For now, it’s safe to say that applying the seven factors to our own lives is going to be one of the best ways for you to work out how to get rich from nothing.

There are a few ways we can do this and many of them can actually be implemented at once.

That is, the list below isn’t something you should do in order necessarily. It’s actually better for you if you examine your financial habits and money mindset and put as many of them as possible into play as soon as you can.

1. Control your spending

We said it before but it’s worth saying again: you’re never going to get rich from nothing if you’re spending more than you earn.

This is why controlling your spending is so important, no matter where in your financial journey you are.

A good way to do this is to track your spending for a month. By doing that, you’ll be able to see exactly where your money is going, including any areas where you may inadvertently be spending more than you realized.

From there, keeping track of your financial situation on an ongoing basis is key. For this, I always recommend Personal Capital.

It’s a great, free app that lets you track exactly where your money is coming in and out, as well as being able to give you a clear snapshot of your finances at any moment. Not only can it save you money, but it will also help you correct any mistakes you may be making before they get out of hand.

Personal Capital

Our pick: Best budgeting app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

2. Get into the right mindset

Getting into the right mindset is critical for building your wealth. As mentioned above, the question of how to get rich in a short time isn’t actually the question you should be asking yourself.

Instead, getting rich from nothing takes time. And given that you’re going to be working on reaching financial freedom for potentially decades, it’s really important that you’re mentally committed to what’s involved here.

In particular, this is going to help when you’re tempted to stray from the course. Some fun money is absolutely fine – in fact, I’d argue it’s critical for anyone who plans to stick to a wealth building strategy long term.

But if you’re the kind of person who’s tempted by the newest release of your favorite brand of phone or who feels like they need to have a new car every three years, having the right mindset will help you get past this and make sure your money is focused where it should be.

Related: Rich vs Wealthy: What’s the Difference and How You Can Get There

3. Commit for the long haul

The “how to get rich fast” crowd has always had an audience on the internet. The problem is that their message simply doesn’t work.

Instead, it’s important to acknowledge that you’re going to be in this for the long haul. I’ll discuss below how amazing compound interest is but, essentially, it does take a number of years for your money to work its magic and grow to seven figures.

This can be tough when you’re at the start of your money making journey, as looking down a path that’s potentially decades long is, frankly, daunting.

But when you think about the alternative of, say, not being able to retire, committing for the long haul is definitely the right way to go.

4. Pay off debt

Let’s be honest: you’re never going to be able to get rich from nothing if you carry debt. This is particularly the case for high-interest debt, like on your credit card.

What this means is that if you have any debt, it’s imperative that you focus all your efforts on paying this off. Otherwise, your money will continue to go straight to the bank’s pockets as interest rather than being used to grow your own wealth.

(It helps that this is also one of the best ways to get a good credit score.)

Personal Capital can help you do just that with its automatic spending tracker and personalized money management tips. Find out more about this free app here.

(One possible exception to turbo charging your debt payoff is your mortgage, given how low the interest rate on this will be. If that’s the only debt you have, a general rule is that it’s going to be better to keep making the minimum repayments and invest the rest rather than putting it towards your debt.

That said, this will depend on your individual circumstances, so make sure you do the math.)

So for those with high-interest debt, it’s going to be even more important than usual that you limit your spending. Starting a budget is a great way to help you with this and I particularly recommend the 50/20/30 budgeting method.

This involves spending 50% of your income on your needs, 30% on your wants and 20% on your financial goals. Why this works for a lot of people is it makes sure you have some money for fun things, so you’re not completely depriving yourself.

The other reason this budgeting method is so good is it ensures that some of your money each month is allocated towards your financial goals. In this case, that’s going to go towards getting you out of debt.

Related: Is Being Debt-Free the New Rich? (13 Pros and Cons)

By budgeting in this way, it means that you won’t find yourself in a situation where you get to the end of the month and don’t have enough money left over for this goal. Instead, the money to make this month’s repayment is already there and part of your budget.

Our free budget template below can help you get started with this. It will show you exactly how to divide your spending up into these three categories and make sure you’re able to stick to the recommended percentages every single month.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

5. Set clear, actionable goals

Having clear, actionable goals is important for achieving any objective in your life, and the goal of getting rich is no exception. Otherwise, your efforts are going to be a bit aimless and it’s going to be less likely that you’re able to hit the money marks you’re looking for.

A good idea can be to set goals that are SMART – that is, they are:

- Specific – “Getting my money under control” is a good goal to have, sure, but “paying off my credit card debt” is a much more specific goal that makes it easier for you to aim for.

- Measurable – Having goals with set amounts is important for helping you to track your progress and stay motivated. To continue the previous example, having “paying off $10,000 of credit card debt” as your goal makes it much easier for you to tick off milestones along the way and keep you driven towards achieving this.

- Achievable – Setting goals that aren’t feasible is setting yourself up for failure. Instead, make sure the financial goals you’re putting in place are ones you can actually achieve within the timeframe you’re setting for yourself.

- Relevant – This refers to having goals that are relevant for you. To help, asking yourself if your goal is worthwhile, in line with your financial efforts and whether you’re the right person to reach that goal can really help.

- Time bound – without a target date for achieving your goal, it’s going to be hard to push yourself to achieve it as quickly as you can. Instead, make your goal something like “paying off $10,000 of credit card debt in the next two years“. You could also break this down further to have sub-goals of paying off $2,500 in the next six months, just to make sure you’re on the right track.

Related: The Personal Financial Plan Example You Can Use To Reach Your Financial Goals

6. Start investing as early as possible

There’s one simple concept that every wannabe millionaire should keep in mind: the earlier you start investing, the richer you’ll be.

Remember that table at the start of this article which showed when you’ll become a millionaire based on how much and when you start saving? If not, here it is again:

You probably noticed that those who start saving and investing when they’re younger become millionaires much, much earlier.

This is because of compound interest. And I can prove it with some simple math.

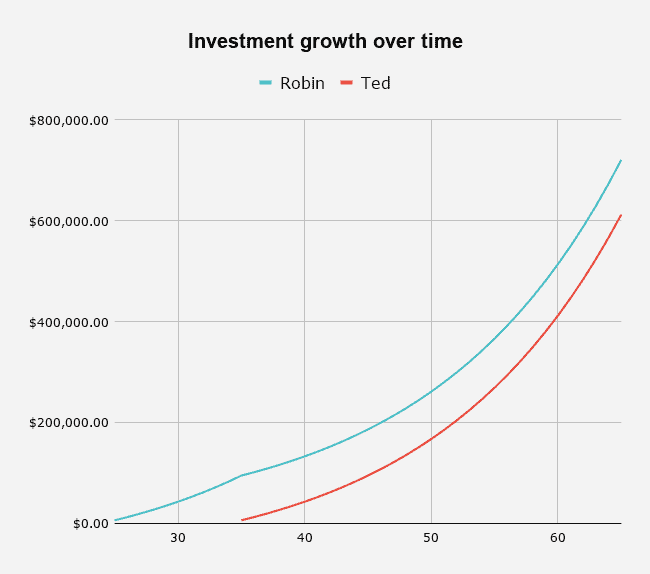

Let’s take Robin, who started to invest $500 per month at the age of 25. She invests this amount for 10 years until she turns 35, when she decides to stop and just leave the money sitting in her retirement account.

Her friend Ted also starts investing $500 per month, but only starts when he’s 35 years old. He continues to invest that amount until he turns 65 and retires.

At an annual rate of return of 7%, which is the average for the market over time, Ted’s 30 years of investing will leave him with just over $606,000 based on having invested $180,000 of his own money. Pretty good!

However, noting that Robin only invested for 10 years with only $60,000 of her own money, she’ll end up with more than $771,000.

That is, for starting 10 years earlier and investing $120,000 less, she ultimately had almost $160,000 more.

What this shows is that starting to invest as early as possible to allow your money to have time to compound is critical for building wealth.

This can also be flipped around: the later you start investing, the more of your own money you’ll have to contribute to grow your net worth to seven figures.

So if you want to spend less of your own money and end up with more – and who doesn’t – it’s important that you start to contribute to your investments as soon as you can.

7. Keep learning

We’ll get to it shortly, but spoiler alert: one of the key factors from The Millionaire Next Door on how to be a millionaire is being good at pursuing market opportunities.

And one of the best ways to identify areas in your life where you could make more money is to always make sure you’re continuing to learn.

This could be as simple as making sure you listen to a personal finance podcast or an audiobook on your way to work rather than the radio.

(By the way, did you know that you can get two free audiobooks by signing up for a free trial with Audible? Simply cancel your membership before the end of the trial to avoid getting charged and you get to keep the audiobooks.)

Another option is to track down people in your network who have already achieved your financial or career goals. Offer to buy them a coffee to pick their brains – the things you could learn from them would be more than worth the cost of a latte.

However you do it, learning about and applying strategies of those who’ve come before you can help you to achieve your goals even faster. In particular, it will help you to avoid their mistakes and apply the lessons learned to your own life.

Related: 17 Best Financial Planning Quotes to Inspire Your Money Makeover

Where can I start learning about how to get rich from nothing?

For those just getting started with learning about financial concepts, I always recommend the book The Simple Path to Wealth by J.L. Collins.

It’s a fantastic, very straightforward book that explains exactly how the author manages his own money, including the incredibly simple yet effective way that he’s invested his money over time to become a millionaire himself.

(And if you want to apply that earlier audiobook tip, you can grab the audiobook of The Simple Path to Wealth here – but I’d recommend signing up for the free audiobook trial first so that you can get it for free.)

Other finance-related books that I’ve personally read and can recommend include:

- The Richest Man in Babylon by George S. Clason

- I Will Teach You to be Rich by Ramit Sethi

- A Random Walk Down Wall Street by Burton G. Malkiel

8. Build up your income

One of the biggest surprises coming from The Millionaire Next Door is that it showed us that you don’t have to be a high income earner to get rich from nothing. At the same time, the higher your income is (when combined with controlled spending), the more you’ll have left over to invest and grow your wealth.

This means that building your income over time is important. This could be as simple as taking advantage of any opportunities in your work to increase your income, such as regularly renegotiating your salary or shifting jobs every few years to enjoy the income boost this usually involves.

However, the strategy that many millionaires apply is to build multiple sources of income. Starting a side hustle is a great example of this, as it allows you to develop another source of income that’s completely separate from your main job.

(You could even do what many people do and build this to the point of being a passive source of income, meaning you don’t have to spend all your spare time out of work focusing on this if you don’t want to.)

Not only is this great for growing your income, but it also means you don’t have all your eggs in one basket in terms of where your money is coming from. This can be a good safety net if, say, your hours are cut or even if you have to live without a job for a while.

9. Automate your finances

Automating your finances is a great trick that not enough people talk about. It means that most of your financial obligations are taken care of as soon as your income hits your account by making sure it’s sent where it’s supposed to go. It also saves you from having to keep track of your bills – as they’ll be sorted out for you already!

This includes things like making sure debt repayments are set to be automatically paid. By making sure this happens a few days after you’re paid each month (just in case your pay check is delayed for some reason), you’ll always know that you have money to pay towards this debt, avoiding any late or non-repayment fees.

This should also include making sure that a portion of your income every month is sent to add to your investments. This could include sending a certain amount of money to your 401(k) or other retirement account of choice.

By doing this, you’re removing any chance of human error, such as if you forget to make a credit card repayment and then accidentally spend the money that was supposed to go to that. It also makes managing your money as hands off as possible, leaving you more time to do the things you actually enjoy doing – or to, say, work on that side hustle to generate even more income.

10. Stay the course

This tip is probably the least exciting of all of them, but it’s going to be one of the most important ones during your wealth building journey.

As the example of Robin and Ted showed above, getting rich takes time. And history has shown that those “how to get rich quick for free” gurus don’t know what they’re talking about.

Instead, as was also clearly established in The Millionaire Next Door (and as we’ll explain further below), the best right way to get rich is to consistently apply solid financial management for years.

I know; it’s not as sexy as the thought of getting rich by this time next year.

But it works. Not only that, it’s a strategy that works for the most people in that, no matter your income, applying these key principles will, eventually, let you build your wealth to the point where you’re financially secure.

It’s true that it’s not always going to be easy. There are always going to be temptations to spend your money on something more fun than your 401(k). It’s also very likely that you’ll experience periods where your income drops, making it much more difficult for you to manage your money the way you want to.

But it’s also the case that the earlier you sort out your finances now, the more easily you’ll be able to weather financial storms like that.

So make sure you stay the course by always remembering what the ultimate goal is here: financial independence.

If anything, that’s way sexier than whatever you wanna spend your money on now that you’ll probably forget about by this time next year.

(It also helps that it’s been proven that money buys happiness…)

Proof that the longer you stick with it, the more your money will grow

We can also use the power of math to prove that sticking with an investment strategy for longer will inevitably make you richer.

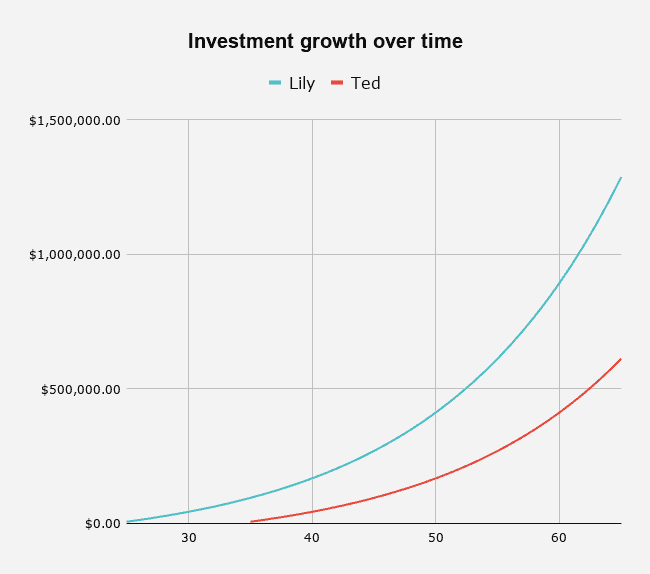

Remember Ted, who invested $500 per month from when he was 35 years old until he turned 65 and retired?

Just to refresh your memory, we determined that Ted will have $606,000 by the time he retires, having only invested $180,000 himself and assuming an annual rate of return of 7%.

That’s definitely nothing to sniff out. But we’re here to become millionaires, so what happens if you stick with it even longer?

Well, his friend Lily follows the exact same investment strategy, but she started when she was 25 years old. She then continued in exactly the same way, finishing when she was 65 and ready for retirement.

That extra 10 years of investing meant that she stuck with this strategy for 40 years, investing $240,000 of her money in the process.

But just for starting a decade earlier, she’ll end up with almost $1.3 million – or more than double what Ted has. And that’s only for investing an extra $60,000.

What’s the take away here? Well, slow and steady definitely wins the race.

Sure, no one sells “how to get rich in a short time” books from telling you to do the same thing for 40 years. But there’s absolutely no question that this is the key to how to get rich from nothing.

After all, the math doesn’t lie.

How to become rich with no money (based on the research)

So I keep mentioning this book, The Millionaire Next Door. But what did it actually find?

As mentioned earlier, it looked at almost 300 millionaires in the US and found, surprisingly, that most of them are on very average incomes, living in very average communities

This shows that becoming a millionaire doesn’t necessarily require a high income. Instead, there were seven common factors that most of these millionaires shared – which, if you implement them in your own life, will put you well on the path to a seven-figure net worth too.

1. Live below your means

This is probably the biggest factor that will allow you to get rich from nothing. Essentially, building your wealth comes down to one simple equation: spend less than you earn and invest the rest.

This means that living below your means is critical for giving your money time to grow. It’s exactly why we consistently recommend that getting your spending under control is the first step to securing a financial future.

TAKE BACK CONTROL OF YOUR FINANCES

Our free budget planner will help you to quickly and easily take control of your money – instead of it controlling you.

Get it free for a limited time!

You’ll also join our mailing list to get updates on how to manage your money – unsubscribe at any time at the end of each email.

2. Efficiently use your time, energy and money to build your wealth

Wasting time is simply wasting money. This isn’t to say that you should be working 24/7, but one common trait in the millionaires that the book looked into is that they used their spare time effectively for achieving their goal of a seven-figure net worth.

This means that you should seriously look at how you use your own time and energy to see if there’s any way you could be using it more effectively. For example, could you do something like starting a side hustle or even learning more about how to manage your money more effectively?

It’s fine to leave some time for Netflix, but if you find yourself spending hours flicking through social media or thinking that the key to your future wealth is going to be your itchy left hand, there’s definitely room there to grow.

3. Value financial independence over social status

We all know in theory that “keeping up with the Joneses” isn’t a way to manage your money well. That said, it can be very easy to forget this when you’re told that you absolutely should be living in a certain suburb, even when there’s a much cheaper place to live that’s just as good.

Things like living on the “right street” are basically there to reinforce your social status. And it was this very same concept that the authors of The Millionaire Next Door found as being the undoing of those earning a higher income.

While many of us assume those are the kinds of people with high net worths, the authors actually found that many high income earners spent far too much of their money on maintaining a certain lifestyle that they couldn’t really afford.

The lesson here is that avoiding any temptation to “keep up with the Joneses” is key to getting rich from nothing. Sure, the new model car does look pretty incredible. But so is being able to retire comfortably, securely and even possibly early.

4. Don’t financially depend on your parents (or other family members)

Not everyone has the luxury of being able to rely on the bank of mom and dad, but those who do won’t typically be able to get to the point of having their own financial independence, according to The Millionaire Next Door.

This means that most millionaires have to rely on their own income, not any help from family members. This includes the finding that most of them didn’t have any significant inheritance to rely on.

And the fact that this concept can be reversed is great news for most of us. That is, the fact that you are only able to rely on yourself for your future wealth is a great sign that it’s more than possible for you to get rich from nothing.

Related: I Need to Move Out But Can’t Afford It! What Should I Do?

5. Raise kids who are self-sufficient

If you have kids, it’s great to be in the position of feeling like you’re able to help them out financially if they get stuck.

But the book actually finds that millionaires generally raise kids who are completely financially self-sufficient. What this broadly indicates is that those people who raise their kids with an ability to value money and the benefits of earning it themselves will, in turn, also experience their own financial security.

The fact their children are brought up to have this kind of mindset has the added benefit of allowing these millionaires to focus their money on growing, rather than having to spend it on helping their children and losing out on the value of compound interest over time.

Of course, if you truly want to, you can give your kids some money from time to time (you may even want to do so with these creative ways to give money to teenagers). Just make sure this doesn’t end up being so much money that they start to lose their skills in being self-sufficient.

6. Be good at pursuing market opportunities

This refers to the fact that most millionaires are very good at seeing opportunities to earn even more money.

This doesn’t mean that, say, they’re great at picking stocks. Instead, it can refer to being good at seeing an opportunity in their own career to increase their income.

It could also refer to being able to identify room in your life for something like a side hustle based on some area of expertise you have or some other hole in the market you notice.

7. Choose the right job for you

I mentioned earlier that one of the biggest factors to get rich from nothing is spending less than you earn. This can actually be done in two ways: either reduce your spending or increase your income (or both at the same time).

This means that picking the right job was crucial for many of these millionaires getting to a seven-figure status.

This doesn’t actually refer to picking a high income job necessarily. In fact, we already mentioned how the book notes that many of those earning a high income weren’t actually the same people with a high net worth, simply because they spend too much of what they earn.

Instead, choosing a job you enjoy and you’re good at means that it’s more likely you’ll succeed at it. This will, in turn, lead you to be able to earn even more over time.

How to get rich fast (based on what others have done)

So, after all that, you’re still wondering how to become rich fast? Well, the answer isn’t winning investing your life savings in bitcoin or winning the lottery (although an itchy right hand can maybe help here…or maybe you prefer your left hand itching to lead to lottery luck?)

Instead, it’s scaling up all these strategies to make your money grow even quicker.

You’ll remember how the examples we used here were based on people investing $500 a month, equivalent to $6,000 a year. That’s around 10% of the median salary in the US, which is a great starting point when you’re just beginning your investing journey. However, your aim should be to ramp this up over time.

After all, the more you’re able to invest, the more this can continue to grow, with the aim of making your money work for you.

There are even people spending less than 50% of their income, leaving the remaining 50% (if not more) to continue to work quietly for them in the background. While that may not be possible for you depending on how much you’re earning, it also shouldn’t be the case that you find yourself sticking with investing 10% of your income for the rest of your life.

A far better way to get rich fast – or at least faster than 40 years – is to continually reassess your finances, see where there’s room to cut your spending or increase your income, and then use this extra money to double down on your financial goals.

This graph should make this point for you pretty clearly. It shows how long it will take you to save $1 million depending on how much you’re putting away every year. Like the other examples in this article, it’s also based on a 7% annual rate of return.

Clearly, saving more means you’ll earn more. You don’t need a graph to tell you that. But what the graph shows is just how much time you can save to become a millionaire from nothing simply based on making a few changes to your budget.

Related: How to Calculate Your Savings Rate – and Why You Should

Final thoughts on how to get rich from nothing

What this has hopefully shown you is that you definitely can get rich without a high paying job. It’s also absolutely possible to become rich from nothing.

In fact, The Millionaire Next Door found that starting with nothing can actually make it more likely that you’ll become a millionaire, assuming you follow all the other factors that they identified.

Just to drive the point home, following so-called experts in “how to become rich fast“ doesn’t work. Instead, spending less than you earned, getting out of debt and starting to invest as early and as consistently as you can are absolutely the keys to getting rich.

It’s true that this definitely doesn’t sound as exciting as some of the gurus make their options sound. But research (and the math) has shown time and time again that this is what works.

So get your strategy in place and settle in for the long-haul. Your future self will love you for it.