When you decide to start investing so you can finally start preparing for retirement, working out how to invest 25k is a good place to start.

This doesn’t mean you have to have $25,000 upfront – although it’s not a bad thing if you do, clearly!

But it can definitely be a good milestone to aim for as you start down your own investment path.

And what’s great about the list below is that it doesn’t have to only set out what you should do with $25k, but it can actually form your entire investment strategy.

That is, as your portfolio grows and you continue to consistently contribute to your various investments over time, the exact same strategy set out below will put you solidly on the path to securing your financial future.

What should I do with 25k first?

There are literally thousands of different recommendations out there for what you should do with your investments.

But when it all comes down to it, it’s actually very simple:

Once you’ve gotten rid of the financial anchors that are holding you back (like debt), you want an investment strategy that’s:

- Optimal in terms of tax benefits;

- Uses index funds to take advantage of the diversification and solid growth they offer; and

- Avoids any sort of human error by making things as automated as possible.

Which is why the following is the exact order of what you should do with $25,000 at first.

1. Pay off debt

How much: Pay off in full

If you’re wondering why an article on how to invest $25,000 is starting with a non-investment tip, then it’s important to think about why you’d be investing this money in the first place.

Presumably it’s to set yourself up for retirement, by allowing you to be financially free. However, you’re never going to get to that goal if you have any high-interest debt eating into your returns.

Which is why your priority has to be paying this off – with the possible exception of your mortgage, which isn’t as urgent due to its lower interest rate.

The reason is that even if you earn the market average of 7% per year from your investments, the interest being applied to your debt could easily be the same as or even more than this, meaning you’re coming out with a net loss.

So focus on paying off your high-interest debt as the first step so you can really reap the rewards from your other investments down the track.

Personal Capital

Our pick: Best money management app

Easily our choice for the best app to help you manage your money better.

Create a budget, track your spending automatically, receive personalized advice, get alerts about hidden fees and a ton more – and it’s all free.

2. High interest savings account

How much: Three to six months of basic living expenses

Your next step should be making sure you have an emergency fund with three to six months of basic living expenses in it.

We never know what unwelcome financial surprise is around the corner, so it’s always good to have some savings set aside just in case we need to rely on them.

Whether it be a medical emergency, a tree falling on your roof or something else that your insurance doesn’t cover, like a job loss, having an emergency fund could be the difference between whether this event makes or breaks your finances.

Your emergency fund shouldn’t be kept with your investment funds, as it needs to be easily accessible. It also needs to be maintained in a low risk account, so that there’s no chance that it’s dropped in value at the time you need to use it.

This is why we recommend the high-interest account offered by CIT Bank. It’s completely fee-free with some of the best rates in the business.

And even though these rates won’t come close to what your investments will earn over time, it’s good to have your emergency savings earning at least something while they’re waiting to potentially be used.

CIT Bank – Money Market Account

Our pick: Best high interest savings account

Why? Well, because it’s got:

- 1.00% interest (over 11 times higher than the national average)

- No fees and only a $100 minimum deposit

- FDIC insured, meaning your money’s safe

3. 401(k)/403(b)

How much: Up to the full employer match

Once your emergency fund is taken care of, now we can turn to the question of how to actually invest $25k.

And your next step should be to invest in either your 401(k) or 403(b) account up to the full match.

If you’re not sure what those accounts are, they can basically be defined as follows:

- 401(k): An account offered by many employers, which their employees can contribute to. The employer will then match these contributions up to a set amount.

- 403(b): Similar to a 401(k) except that they are generally only available to employees of public schools and tax-exempt organizations rather than private sector workers. A major difference from a 401(k) account is that employers do not have to match employee contributions into a 403(b).

In both cases, the employee’s contributions are tax-free, meaning individuals can reduce their income tax in the year of contribution. Withdrawals, however, are taxed, although these usually take place after retirement when your income – and thus your tax rate – is far lower.

Given the tax advantages offered by your own contributions and the fact that your employer contributions are essentially free money, you’d be crazy not to take full advantage of this.

Which is why it’s recommended that you should use some of your $25k to contribute to your 401(k) or 403(b) up to your employer’s full matched amount.

4. Health Savings Account (HSA)

How much: $3,550

A Health Savings Account – or HSA – is an account for those who are covered by high deductible health plans (HDHPs) to save for medical costs that the HDHPs don’t cover.

Basically, if your plan means you’re facing high deductibles, you can use an HSA to reduce your health-related expenses. This is because the contributions are invested over time and can be used to pay for qualified medical expenses, which include most medical care such as vision, dental, and over-the-counter drugs.

Contributions can either be made by you or your employer up to a certain amount, which is currently $3,550 for individuals. This limit includes any contributions made by your employer, so if they contribute $1,500, you can only add $2,000.

It’s also super advantageous from a tax perspective:

- Funds that are contributed to an HSA are taken from pre-tax income, thus lowering your overall taxable income

- Whatever you contribute to your HSA is tax-deductible

- Any interest earned in the account is tax-free

In addition, the money you save in an HSA (plus interest) can be withdrawn for any reason without penalty once you reach 65 years old. That said, you’ll have to pay income tax on the withdrawals at that point.

This means you can use these funds for retirement or anything else once you’ve hit that age – although you’re also more than welcome to continue to save your HSA money for healthcare expenses.

So, in summary: if you don’t have to use money in an HSA for health reasons, this is basically an extremely tax advantaged way to invest for retirement.

5. Roth IRA

How much: Up to $6,000

A Roth IRA is an individual retirement account (IRA) with some specific features. That is, it’s similar to traditional IRAs, except that they are funded with after-tax dollars.

This means that contributions are not tax-deductible. However, your withdrawals are completely tax-free.

You can even have a Roth IRA if you also have a 401(k) or 403(b) and, depending on where you open your account, they can be a great way to invest this money in ETFs and other diversified options that we’ll outline below – just with more tax advantages.

You can invest up to $6,000 per year in your Roth IRA although there are some limits where, if you earn too much, you can’t contribute to this type of account. Currently, this starts at $122,000, although it will depend on things like your marital status.

Related: Can You Lose Money In a Roth IRA?

How to invest $25k after that?

If you’ve maxed out all of the options listed above and are still looking for how to invest $25,000, then your next options are some of the more traditional (and not-so-traditional) investment vehicles that are out there.

These aren’t in any particular order, as your choice is going to depend on a number of things such as your risk appetite and investment horizon.

However, having an appropriate asset allocation – that is, the way your portfolio is balanced between different types of investments – is going to be key to making sure you stick with this for the long term.

It’s also a good idea to automate this as much as possible. This should include at an absolute minimum:

- Automatic dividend reinvestment: When your investments pay out any dividends, they should be automatically put back into your investments so they can continue to grow.

- Automatic contributions: Set up your accounts so that a portion of your income each month is automatically transferred out to your investments of choice.

- Rebalance based on a schedule: Set a reminder in your calendar app of choice to check your overall portfolio every, say, three months to make sure that your investments are still divided approximately in line with your asset allocation. If any of them have increased or decreased in value, you may have to adjust your contributions in the following month so that the percentages are “corrected”.

- Don’t sell anything until you retire: Giving your investments time to grow is the best thing you can do for securing your financial future. Even when times get tough during economic downturns, history has shown that the best thing you can do for your own finances is to ride out the turbulence.

Related: The 11 Best Compound Interest Investments To Grow Your Wealth

6. ETF

An exchange traded fund (ETF) is a term that describes a collection of equities, such as stocks, that can be traded on the stock market. They often track an underlying index, which is another term for a segment of the market.

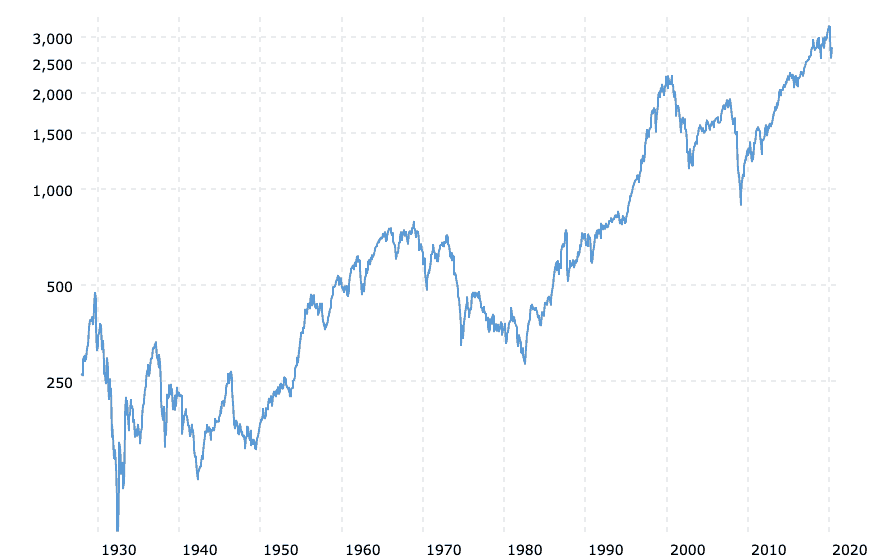

A well known example is an S&P 500 index fund, which is one that tracks the performance of the 500 largest publicly traded companies in the US.

This means that your returns will be the same as the performance of some of the biggest companies in the world such as Microsoft, Apple, Amazon, Facebook and more – without having to directly buy their shares yourself.

This is a great way to invest. In fact, for anyone looking for an extremely low-fee investment option that provides for a massive amount of diversification and strong returns over time, investing into an S&P 500 ETF is one of the best choices you can make.

Related: VOO vs SPY: Which S&P 500 ETF is best?

7. Mutual fund

A mutual fund is similar to ETFs in that they can also track an index, although they’re bought directly from a fund company.

(To give you an idea of what’s on offer, take a look at these examples of Charles Schwab mutual funds that track various indexes.)

This means that a mutual fund that tracks the S&P 500 index is going to perform exactly the same as an ETF that follows the same index.

There are a few differences though, including on points such as minimum investment, tax efficiency, automating your investments and purchasing units.

To get more information on the difference between mutual funds and ETFS, as well as to see which one suits you better, take a look at this article on the difference between VTSAX and VTI.

As a sneak peek: They’re both total stock market index funds, meaning that they track the performance of every publicly traded stock in America, equivalent to more than 3,500 individual stocks. However, VTSAX is a mutual fund and VTI is an ETF.

Related: 12% Compound Interest Accounts? 8 Investments To Earn You Massive Returns

8. Roboadvisor

A roboadvisor is an app or similar platform that automatically invests your money based on information you provide to it.

How this usually works is that you’ll be given several options on how you would like your portfolio to be built, ranging from aggressive to very conservative. The roboadvisor will then allocate your assets for you between a range of stocks and bonds to reflect your choice.

Using a roboadvisor can be a great way for anyone to get into investing who wants to ensure that they’re appropriately diversifying their investments but doesn’t have the time or know-how to do it themselves.

And in our experience, Betterment is one of the best roboadvisors out there. Their fees are extremely low for the market and they have a great range of portfolios. In fact, the system can even suggest a personalized portfolio for you based on your financial goals and where you’re at in life.

The best feature though is that they automatically rebalance your portfolio at regular intervals and also ensure that you’re getting as many tax advantages as possible, both of which make sure that you’re getting the best returns possible.

Related: Acorns vs Robinhood: Which Micro-Investing App is Better?

9. REIT

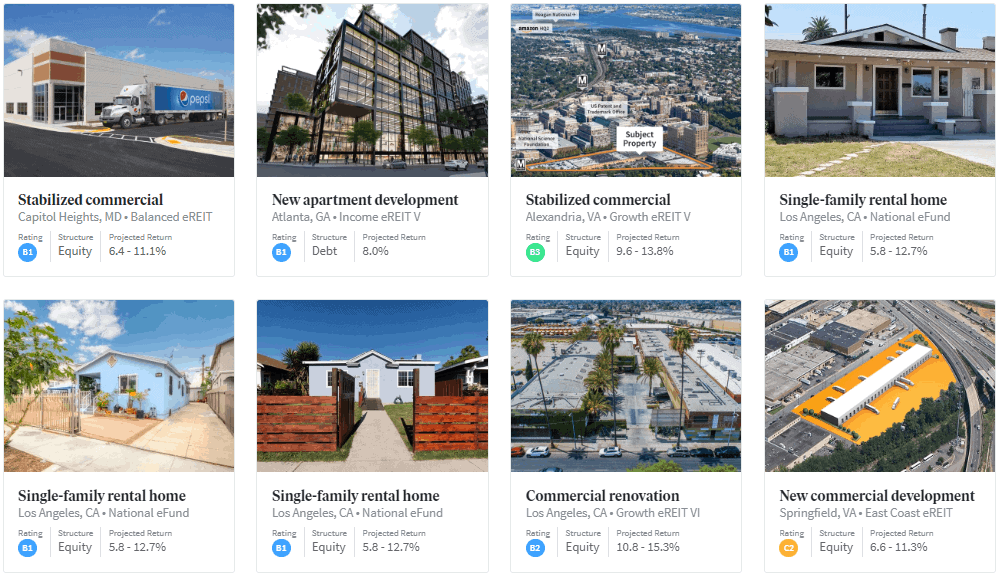

A real estate investment trust (REIT) is similar to a mutual fund in that you pool your money with other investors into a basket consisting of real estate investments. This means that you’re able to earn dividends from these investments, without actually having to own and manage your own properties.

One of the biggest names in this area is Fundrise. With over 150,000 investors, they have literally hundreds of properties into which you can invest without the hassle (and cost) of doing it yourself.

How to invest $25k in real estate?

You’d be getting the deal of the century if you were able to buy your own property with $25,000.

Instead, with a company like Fundrise, you’re able to pick from various portfolios that offer a mix of properties that fit your risk profile.

Your money is then invested into these alongside other investors. And, with only a $1,000 minimum investment, it’s easy to see how to invest $25k in real estate, including if you’re looking to get started with apartment investing (or in other types of property), using this method.

Find out more about Fundrise here.

10. Bonds

A bond involves buying part of the debt owed by a government or company. Then, when the borrowing entity makes its debt repayments, investors receive these payments back as interest as well as the value of the bond once it’s fully paid off.

This is a very low risk investment, which is why a lot of people include bonds in their portfolio to balance out some of the volatility that stocks or some index funds can present on their own. In particular, those who are closer to retirement are more likely to invest in bonds to ensure their investments are more conservative than those who may have the time to ride out any downturns.

At the same time, returns are, on average, going to be much lower with bonds compared to other income generating assets you can own. This means that it’s important to not be too safe, as having too high a proportion of bonds in your portfolio when you’re younger means you may be missing out on the chance to grow your wealth as much as you could. As such, while holding some bonds is a very common investing tip, make sure you have only as much as you need based on your own risk profile

Other investment ideas for how to invest extra money

There are other investment ideas out there that may not be as “traditional” as the other ones listed above, but are still viable options for those looking into how to invest extra money.

Sure, you probably shouldn’t pour your life savings into these. But if you have some extra money to invest and don’t really mind what the outcome is, then taking a risk on some of these could be something you may want to try.

11. Angel investing

Angel investing basically involves putting some money into and owning part of a startup or other small business.

It can be a good option for someone interested in business but without the time or willingness to start a business themselves. And while strong returns are far from guaranteed, this can be extremely lucrative if you end up investing in something like the next Google

(Just ask Andy Bechtolsheim, whose $100k investment in Google is now worth approximately $1.7 billion.)

Take a look at sites like AngelList to see whether this is an option for you.

12. Cryptocurrency

Cryptocurrencies like Bitcoin have been the talk of the financial town for the last few years. With some massive upward swings in its value, early investors were turned into literal millionaires.

The problem is it’s completely unclear which way Bitcoin or any other cryptocurrency is going to go. Either their value will skyrocket again…or they could completely crash and burn.

So sure, if you have some spare money that you can afford to lose, maybe this is one way to invest 25k. But just make sure you’re fully aware of the risks.

Related: How to Invest and Make Money Daily: 7 Proven Strategies

13. Real estate crowdfunding

We’ve mentioned REITs as a way to invest in real estate, but another option is real estate crowdfunding.

That is, this provides a very viable alternative to buying your own property. Not only may that be impossible with only $25,000, but it could also be more trouble than it’s worth.

Can you invest in real estate with $25k by buying property?

It’s clearly going to be difficult to invest in real estate with $25k yourself. But you may just be able to do it by pooling your money with other investors.

Which is exactly what real estate crowdfunding is. It allows a group of individuals to raise capital (i.e. combine your available funds) to finance a real estate project.

Generally, this is done by letting you buy shares in a crowdfunding company, with the company being the property owner. Any profits from the real estate venture are then given back to investors. This can include any including rental income or money made from flipping the property.

Take a look at BrickFunding to see whether there’s a real estate crowdfunding option that works for you.

How to invest $25k safely?

The question of how to invest $25k safely is going to depend on just what is your definition of “safe”.

One way to look at it is: Not investing at all is the riskiest move out there, as it’s putting your entire financial future at risk.

But there are other considerations when determining the safest way to invest $25,000. These may include:

- How long is your investment horizon? That is, are you planning to retire in, say, 40 years or in 10 years? If the latter, you may wish to have a more conservative portfolio to protect yourself from any downturns in that period

- What do you feel comfortable with? Some people – including me – like to put all of their money in a broad market index fund, like one that tracks the S&P 500, as they know that the gains over time have been strong. However, it can also be very rocky when the market drops, which some people may not be able to cope with without panicking and selling.

Some of the “safer” investment options are going to be things like bonds. And while these are great for balancing out the volatility that other asset types may bring to your portfolio, your returns will also be lower over time.

So with all that said, as a general rule, the longer you have to invest, the less conservative your portfolio should be. This is so that you can take advantage of the compounding value that stronger returns will bring you over time.

After all, there’s such a thing as being “too safe”. And you don’t want to sacrifice your financial future just to be “safe” today.

What will $25,000 be worth in 15 years?

It’s impossible to say exactly what $25,000 will be worth in 15 years. Unfortunately, none of us have a crystal ball to know which investment types will have the best returns.

That said, we can take an educated guess based on the historical performance of certain investments.

(This is the part where the reminder comes in: past performance is no guarantee of future performance.)

For example, when looking at the returns of the S&P 500 from 1950 to 2009, the average annual returns have been exactly 7%.

So if we take that number and assume the $25,000 you invest today will experience average returns of 7% over the next 15 years, your investment will be worth $68,975.79.

(And if you manage to invest $25,000 every year for the next 15 years? At 7% per year in returns, you’ll have $741,177.13.)

What will $25,000 be worth in 20 years?

We recommend this free investment calculator when calculating what your money will be worth in future based on your various contributions.

Using that, if you invest your $25k for 20 years with average annual returns of 7%, your investment will have grown to $96,742.11.

And if you invest that $25k every year for 20 years at that rate, you’ll officially be a millionaire, with a portfolio worth $1,193,371.53.

How much money do I need to invest to make $4,000 a month?

As above, this is going to depend on a whole lot of factors.

But if we assume returns of 7% per year again, you’ll need to have $514,285 invested for this to grow in value by $36,000 in a year – equal to $4,000 a month.

This may sound like a lot, but it’s completely feasible over time. You’ll find that by consistently contributing to your investment accounts based on the list above and prioritizing your financial goals over other temptations, you’ll be more than able to grow your portfolio to that amount.

How much can you make by investing $25,000?

Basically, the sky’s the limit!

Let’s say you’re somehow able to invest $25,000 when you’re 25 years old, so you have 40 years until retirement.

Over that time, your initial investment will balloon to $374,361. That’s almost $350,000 just for doing nothing!

Of course, the greater benefit comes from adding to that initial $25,000 investment over time. In fact, it’s the main way for anyone to build their wealth – consistently investing until, over time, you’ve found yourself more financially secure than you could perhaps have dreamed.

Is $25k in savings good?

Having $25k in savings can be good, depending on the circumstances.

If this represents your emergency fund and is enough to cover you for three to six months of living expenses? Perfect, you’re good to go.

But if you’re keeping this in savings because you’re not sure what else to do with it, then it’s time to reread this article to find some better places to put it.

After all, by keeping this money in savings when you probably shouldn’t be, you’re denying yourself some of the amazing returns that these investment options can offer.

And in doing that, you’re avoiding one of the key factors to building wealth: making your money work for you.

Don’t get us wrong, saving $25k in itself is amazing, especially given that it’s been found that only 40% of Americans could cover an unexpected $1,000 expense.

But the next step needs to be figuring out where to put this money so that it’s working as hard for you as you worked to save it in the first place.

Smartest thing to do with $25k

While everyone’s investing choices differ depending on their personal circumstances, in our opinion, the smartest thing to do with $25k (or even more, if you have it) is to follow the order in this article.

That is:

- Pay off your high interest debt

- Build your emergency fund to three to six months of basic living expenses

- Contribute to your 401(k) and/or 403(b) retirement account up to the full employer match

- Contribute to your HSA up to $3,550

- Contribute to your Roth IRA up to $6,000

- Invest whatever is left over each year into your investments of choice – for most people, that’s going to be a mix of low-cost index funds, possibly with some bonds

Final thoughts on how to invest $25,000

Having an investment strategy that you’re able to stick to for the coming years is one of the best things you can do for building your wealth.

And whether you have $250, $25k or $125k to invest, the steps set out in this article will help to ensure that you’re benefiting from all the tax advantages that many retirement accounts offer – before you then take the next steps of really throwing yourself into the investment pool.

The two best things you can do for your financial future are to start investing early and keep investing consistently. By following what this article suggests, you’ll be well on your way to achieving this.